Crude oil prices dipped in early trade on January 8 on sharp price cuts by top exporter Saudi Arabia and a rise in output by the Organisation of the Petroleum Exporting Countries (OPEC), offsetting worries about escalating geopolitical tensions in the Middle East.

Probal Sen, Energy Analyst at ICICI Securities, shared his outlook for oil, and on stocks in the oil and gas space.

According to Sen,

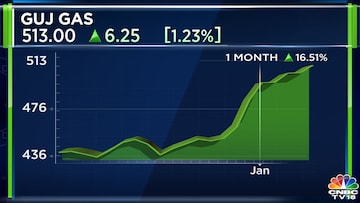

Gujarat Gas is likely to maintain its strength over the next few months. The stock's performance hinges on the propane versus gas dynamic, with recent propane price upticks to $610-620 a tonne. This, coupled with softening LNG prices to $15-15.50, bodes well for Gujarat Gas in terms of price competitiveness. However, Sen advised investors to sell into the rally, citing murkiness in long-term prospects from a volume perspective.

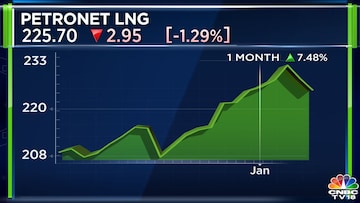

Petronet LNG, he noted, operates as a price taker in the volatile oil and gas market. While remaining positive on the overall sector, he noted that softer prices act as a benefit for most companies in the space.

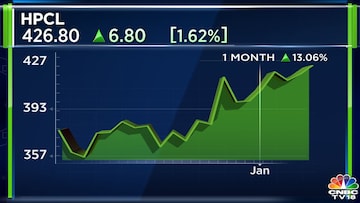

Sen continues to be positive on oil marketing companies (OMCs) such as

Hindustan Petroleum Corporation (HPCL). He highlighted the government's clear message of no urgency for significant fuel price hikes. This stance, along with decent refining margins and strong marketing, positions HPCL favorably from a two to three-year perspective.

Sen projected a robust 14% year-on-year (YoY) improvement in the earnings before interest, tax, depreciaton, and amortisation (EBITDA) and an 8% YoY improvement in profit after tax for

Reliance Industries (RIL).

On Monday morning, Brent crude was marginally down at $78.67 a barrel, while US West Texas Intermediate crude futures shed 0.1% to $73.71 a barrel.

For more, watch the accompanying video

(Edited by : Shweta Mungre)