Rahul Arora, CEO of Nirmal Bang Equities, urged investors to exercise caution amidst the dynamic surge of new-age companies in the market.

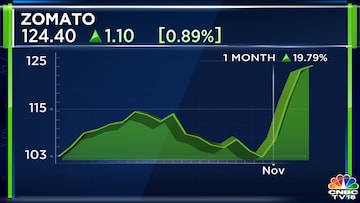

In a chat with CNBC-TV18, Arora said that while firms like Paytm and Zomato have seen their valuations skyrocket after going public, there's been a noticeable shift towards profitability and decreased cash burn. This shift has strengthened their market positions.

But Arora is concerned regarding the sustainability of these businesses; whether they can maintain self-sufficiency through cash flows, or will require continual capital infusions.

Also Read

Arora pointed out that even industry giants such as Reliance are venturing into the competitive arenas of new-age companies, intensifying the market dynamics. He cited Reliance's rollout of Tira stores as an example, which positions the conglomerate as a direct competitor to established beauty and personal care retailers like Nykaa

"I am not saying that the disruptors are going to be disrupted, but even if Nykaa reports earnings per share (EPS) of around ₹2.5-3 this year, it is trading at a valuation north of 50 times earnings, signifying intense competition in the space," he said.

Shares of FSN E-Commerce Ventures, parent of e-tailer brand Nykaa, nearly turned positive for the year on Tuesday, November 7, after analysts projected a potential upside of up to 40% over the next 12 months.

For the September quarter, Nykaa reported revenue growth of 22.4% compared to last year, while operating profit or EBITDA increased by 32.1% year-on-year.

The company's beauty and personal care business grew by 19% during the quarter, while the fashion business, a relatively smaller part of the business, grew by 32% year-on-year.

In the case of Paytm, Arora observed a significant increase in competition over the past few years from smaller players who have secured funding.

Paytm reported a largely in-line September quarter (Q2FY24), with sustained momentum in gross merchandise volume (GMV) and healthy growth in disbursements.

Paytm shares have more than doubled from an all-time low of ₹438 earlier in 2023 but still remain nearly 55% below the IPO price of ₹2,150

Disclaimer: Network18, the parent company of CNBCTV18.com, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

For more details, watch the accompanying video

(Edited by : Shweta Mungre)