Nikhil Kamath in an interaction with CNBC-TV18 earlier today mentioned that besides Nazara Technologies, he has investments in other listed entities as well.

We tried to dig a bit of data and stumbled upon four other names in which he has a stake. But here are some other filters that we put in place to come up with this data.

The data is available on the exchanges

Exchange data is only available for stakes that is in excess of 1 percent

All stakes are in the name of Zerodha BrokingAnd lastly, a disclaimer, that it is possible that he may have investments in other entities as well.

So let’s take a look at the four names

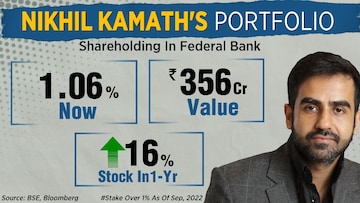

First up is Federal Bank. Now Zerodha's name in the private lender showed up in the list of shareholders for the first time in the September 2022 quarter.

As of date, Zerodha's 1.06 percent stake in the bank is valued at over Rs 356 crore. Since that period the stock of Federal Bank has risen 16 percent.

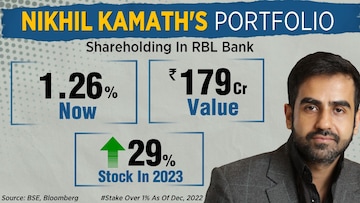

Next up is RBL Bank, which has already been in the news over Mahindra & Mahindra acquiring stake in it. Zerodha too has a stake in the bank since the December 2022 quarter, which is when their name first showed up. Shares of RBL Bank are up nearly 30 percent so far in 2023.

BSE is next and it just refuses to stay away from the headlines courtesy its proposed share buyback. Zerodha had first acquired 1.6 percent stake in BSE in September 2020, which it increased to 3.7 percent by June of 2021. As of date, that 3.7 percent stake is valued at close to 200 crore rupees. Since September 2020, shares of BSE have risen by nearly 500 percent.

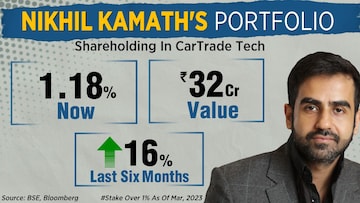

Lastly, an interesting name that features in this list is Cartrade Tech. Zerodha's stake first showed up in the shareholders names in March this year, and that 1.2 percent stake is currently valued at over 30 crore rupees. Interestingly, while CarTrade's shares have declined nearly 70 percent from their IPO price, they are up 16 percent from March this year.

First Published: Sept 4, 2023 4:24 PM IST