India's equity markets have experienced an unprecedented bull run, surpassing global markets since the beginning of the new millennium. The

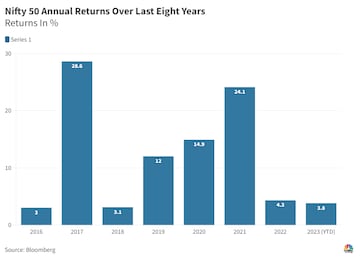

Nifty 50 index, reaching all-time highs, has gained nearly five percent this year. Impressively, the index has delivered

positive returns for the eighth consecutive year, with the last instance of negative returns occurring in 2015.

Mark Matthews, an analyst from Bank Julius Baer & Co, expressed regret for not being optimistic about India in the past. However, he has now become bullish on the Indian

markets and anticipates further growth from the current level of 19,000. Matthews points out four key reasons for his newfound optimism.

Firstly, he highlights the Indian government's establishment of a strong

economic foundation, which recent developments have built upon. Secondly, the corporate sector has successfully reduced its debt while the non-performing assets (NPAs) of public sector banks have been effectively addressed, contributing to a healthier and more resilient economic environment.

Matthews also highlights the opportunity for India to attract capital inflows as investment preferences shift away from China. With China losing its status as the preferred market in Asia, investors seeking alternative options are increasingly turning their attention to India.

"I wasn't always a bull on India and I regret that. However, I am now bullish on India. I think the Indian market can go higher and there are four reasons for that. The first reason is that the government has laid the foundations that are now being built for a very strong economy. Secondly, the corporate sector balance sheet by and large is deleveraged and PSU bank NPAs have been taken care of. The third reason is, China was the market in Asia that everybody wanted to be in, it isn't anymore and so that money can flow into India," Matthews said.

Another crucial factor Matthews considers is the role of banks in driving economic expansion. He emphasises that as the Indian economy grows, banks stand to benefit greatly. The positive trajectory of India's economy, coupled with the improved position of Indian banks for lending, creates a favorable environment for increased credit activity. Additionally, the high capacity utilisation rate, ranging from 70-80 percent, indicates the potential for a long-awaited surge in the capital expenditure cycle.

In May 2023,

fresh project announcements in India witnessed an 81 percent year-on-year growth, amounting to Rs 2.5 lakh crore. Notably, the private sector contributed 70 percent of these announcements, compared to 45 percent in the same period last year.

Watch video for entire conversation.