As fiscal year 2024 (FY24) draws to a close, Dalal Street, the heartbeat of India's financial markets, celebrates a triumphant journey marked by remarkable gains. The Nifty index, a benchmark for the National Stock Exchange of India, surged by nearly 30%, showcasing its most substantial returns since 2010, excluding the turbulent pandemic period.

Simultaneously, the Sensex, representing the top 30 stocks on the Bombay Stock Exchange, recorded a 25% increase. However, stealing the spotlight were the midcap and small-cap indices, with the midcap index skyrocketing by 60%.

On the global stage, India emerged as the third-largest gainer, trailing behind Japan's Nikkei, which witnessed a 44% surge, and the Nasdaq, boasting a 40% increase during FY24.

The standout performers in FY24 hailed from sectors that had previously experienced sluggish growth.

Public sector undertakings (PSUs), real estate, power, and auto sectors emerged as the top winners.

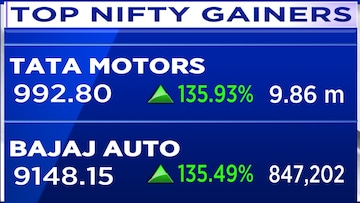

Topping the charts on the Nifty were

Tata Motors and

Bajaj Auto, showcasing gains of approximately 135%, closely followed by

Adani Ports,

Coal India, and

Hero MotoCorp, which recorded gains ranging between 101% and 112%. However, not all stocks basked in the glory, with Hindustan Unilever and

HDFC Bank underperforming by approximately 11%.

In the broader market spectrum, stocks such as Suzlon, Zomato, Adani Power, Trent, and Wockhardt registered substantial gains, ranging between 100% and 200%.

Factors Driving the Bullish Momentum

Several factors underpin the bullish sentiment pervading the Indian stock market:

Surging Retail Flows: A significant catalyst for the market's outperformance has been the surge in retail investments. Monthly

Systematic Investment Plan (SIP) inflows have remained robust, ranging between

₹16,000-

₹18,000 crore, contributing to market liquidity and stability.

Expectations of Earnings Growth: Investors are buoyed by the anticipation of consistent earnings growth for Nifty companies, projected at around 15%. This expectation further fuels investor confidence and market optimism.

Monetary Policy Outlook: Markets are factoring in expectations of three rate cuts from the US Federal Reserve, coupled with favourable liquidity conditions.

Global Bond Index Inclusions: India's inclusion in prominent global bond indices like Bloomberg and JPMorgan has contributed to benign yields, with forecasts indicating a potential slip in the Indian 10-year yield below the 7% mark. This augurs well for investment attractiveness and capital inflows.

Looking Ahead

While the Indian stock market celebrates its stellar performance in FY24, several factors warrant vigilance moving forward:

Crude Oil Prices: The trajectory of

crude oil prices remains a critical determinant, with fluctuations potentially impacting market sentiment and economic stability.

Federal Reserve Policy: The pace and magnitude of rate cuts by the US Federal Reserve will continue to influence global market dynamics, including India's.

Election-Related Volatility: Political developments, particularly with impending Lok Sabha elections, could introduce volatility and uncertainty into the market landscape.

As Dalal Street concludes FY24 on a high note, investors remain cautiously optimistic, cognizant of both the opportunities and challenges that lie ahead in the ever-evolving landscape of the Indian financial markets.