The Nifty PSU Bank index, an index of India's state-run lenders ended 6 percent lower on Friday, ending the session as the top sectoral loser.

Friday's drop was the second biggest drop for the PSU Bank index in 2022, after the 8 percent that it shed on February 24.

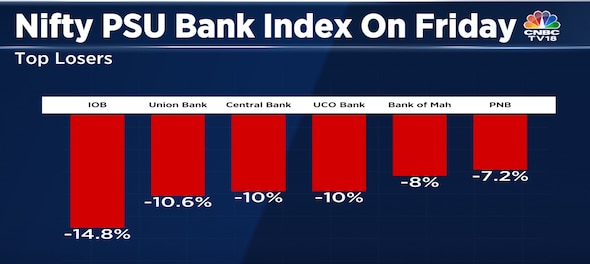

After a stellar run over the last few weeks, the index declined for the seventh straight session on Friday. All the index constituents ended with losses between 1-15 percent, led by Indian Overseas Bank.

Here's how the PSU Bank index constituents fared on Friday:

| Stock | Friday's Drop |

| Indian Bank | -0.80% |

| State Bank of India | -3.40% |

| Bank of Baroda | -4.20% |

| Punjab & Sindh Bank | -5% |

| Canara Bank | -6.30% |

| Bank of India | -6.90% |

| PNB | -7.20% |

| Bank of Maharashtra | -8% |

| UCO Bank | -10% |

| Central Bank of India | -10% |

| Union Bank | -10.60% |

| Indian Overseas Bank | -14.80% |

Since hitting a peak of 4,617.40 on December 15, the index has corrected nearly 1,000 points in the next six trading sessions, shedding close to 15 percent.

The PSU Bank index is still one of the best performing sectoral indices this year. At its peak, the index had more than doubled from its 52-week low of 2,283.

The primary reason behind the upswing was a steady fall in gross non-performing assets (NPAs) or the 'bad loans' on all their balance sheets.

The net NPAs were even lower than they were in 2016, i.e. before the asset quality review (AQR) started in 2017 by the Reserve Bank of India (RBI).

Moreover, PSU banks have steadily increased their profits and their loan books too. The latest reading is almost 17 percent in the last available quarter.

As a result, PSU Banks ranging from PNB to Bank of Baroda and Bank of India received a slew of analyst upgrades from institutional brokerages like Morgan Stanley, Credit Suisse and JPMorgan. The market capitalisation of PSU Banks also crossed the Rs 10 lakh crore mark for the first time recently.

PSU Banks as a space was not anticipated to do well this year, according to Anshul Saigal of Kotak PMS. "If you were in the right stocks in this year, you obviously made a lot of money, look at what happened to the PSU banking space," he said.

Vijay Chopra of Enoch Ventures believes that banks like Canara Bank, Bank of Baroda or even SBI are a great buy in such a correction. Union Bank, Canara Bank and SBI are his top picks from within the space.

Market Expert Anand Tandon expects the PSU Banks to continue to do well and he believes that the correction in these banks is more or less done. He expects the corporate facing banks to do well going forward.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

In Andhra's Pithapuram, its Pawan Kalyan's charisma vs YSRCP MP Geetha's credentials

May 8, 2024 10:23 AM

Lok Sabha elections: 3rd phase sees over 65% voter participation, Assam leads with 81.71% turnout

May 8, 2024 1:00 AM

Telangana CM violated poll code, defer Rythu Bharosa payment, says Election Commission

May 7, 2024 9:01 PM

Lok Sabha Election 2024: How Indian political parties are leveraging AI

May 7, 2024 6:59 PM