Brokerage firm Kotak Institutional Equities has dropped its recommended midcap portfolio as it does not find many stocks beyond the Banking and Financial Services (BFSI) space that offers decent upside potential to their 12-month price targets.

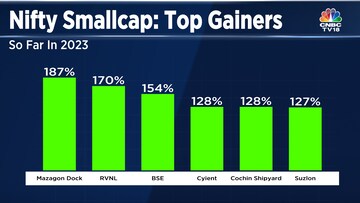

While the Nifty Midcap index has gained 31 percent so far in 2023, the Smallcap index is up 33 percent. Both the indices are trading at a record high.

Most of the non-BFSI stocks in Kotak's midcap portfolio are trading above their 12-month price target. "The valuation of stocks in our favourite capital goods, healthcare, QSR and Real Estate sectors discount growth for the next few years and leave absolutely no room for any disappointment," the Kotak note by Sanjeev Prasad, Anindya Bhowmik and Sunita Baldawa said.

"We see limited point in trying to find fundamental reasons behind the steep increase in stock prices of several mid-cap and small-cap stocks. There is no meaningful change in the fundamentals of most companies," the note said, adding that in some cases, it has even worsened.

Kotak's note attributed the rally to "irrational exuberance among investors," with high return expectations being driven by the high returns of the past few months.

It attributed the market sentiment to be exuberant based on three factors:

Steep increase in the prices of many mid and smallcap stocks

Large inflows into mid and smallcap mutual funds and

Huge number of new retail participants in the midcap and small cap fundsKotak's note also spoke about many stocks that are being termed as turnaround stories. "Many of these companies have been through serious operational and financial challenges in the recent past, but the market has high hopes of these companies doing well in the future."

"We are not sure of the basis of the market's confidence," the analysts wrote in their note.

First Published: Sept 11, 2023 10:55 AM IST