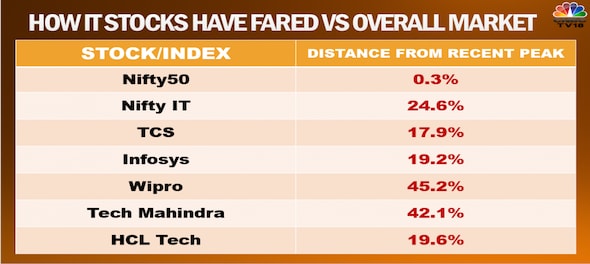

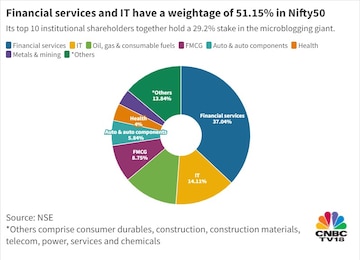

India's IT space has been among the worst places on Dalal Street for investors to be in for the past few months. A sector with more than 14 percent weight in the Nifty50 index — second only to financial services at 37 percent — IT is yet to participate in the slow and gradual recovery that has brought the market within inches of its lifetime highs, scaled in October 2021.

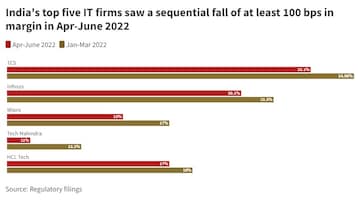

The country's top software exporters — from TCS, Infosys, Wipro, HCL Tech and Tech Mahindra — have yet to overcome margin pressure on account of higher employee costs despite healthy spending on technology across sectors.

The current recovery in the market is on the back of intermittent return of foreign portfolio investors to Indian shares. However, analysts believe it may be a while before FII inflows gather steam for Dalal Street to the degree that powered a chain of record highs in a near 18-month-long rally till October 2021.

While the financial services space has driven much of this recovery, strong participation of IT shares will help the market sustain fresh peaks. However, despite robust demand for technology, Indian IT companies continue to battle against the higher employee costs — thanks to a high degree of attrition — that continue to eat into their profitability.

Can the average bull expect a comeback in IT stocks anytime soon?

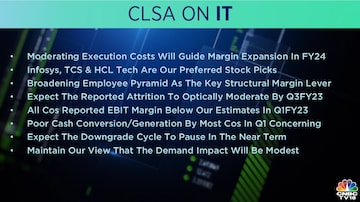

"We have a constructive view on the IT sector after the severe price-to-earnings de-rating in 2022. We believe that margins have bottomed and supply-side normalisation will be a positive," Apurva Prasad, Institutional Analyst at HDFC Securities, told CNBCTV18.com.

"Contracting activity, despite the tough macroeconomic environment, reflects the increase in cost optimisation priorities of clients, that will support growth for the sector. Short-term volatility in the sector provides a strong opportunity for absolute returns," said Prasad, who prefers Infosys within Tier-I IT space and Persistent Systems in Tier II.

Market expert Saurabh Mukherjea believes it is unfair for several market participants to turn bearish on Indian IT on the pretext that they have a robust deal pipeline.

"The West is only 1/3rd of the way through the shift to the cloud. There is work to be done, so it doesn't matter what the GDP growth in America, Sweden or the UK is. The Indian IT services companies will carry on getting plenty of work, and on the back of that, they will post healthy results for many years to come," Mukherjea told CNBC-TV18.

Technically, many believe the Nifty IT is in for some time- and price-wise correction given its spectacular escape from COVID lows in the market rally that ended in October 2021.

"The Nifty IT looks ready to head towards 34,000 once it sustains above 30,300-30,500-odd levels. Plus, a cool-off in Fed policy is good for the mother market (Wall Street), and this will have a positive rub-off on the Indian indices," said Viraj Vyas, Technical and Derivatives Analyst at Ashika Group.

However, many experts foresee fresh record highs in the Nifty50 before one significant correction owing to global markets before one can expect a sustained upmove.

Nifty staged a mixed earnings season in the July-September period.

The 50-scrip basket's 12-month forward earnings per share (EPS) estimate has declined by half a percent from the October high to Rs 926. The basket's aggregate profit stood at Rs 1.47 lakh crore in the earnings season, which is eight percent above Street estimates.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Election | Which way the wind blows in the second phase

Apr 26, 2024 6:09 PM

Election Commission registers case against BJP's Tejasvi Surya for alleged violation of poll code

Apr 26, 2024 5:08 PM

2024 Lok Sabha Elections | Why Kerala is in focus as the second phase begins to vote

Apr 26, 2024 9:33 AM

Bengaluru Rural Lok Sabha election: Over 60% voter turnout recorded by 5 pm

Apr 26, 2024 9:11 AM