The Nifty IT Index, the worst sectoral performer of last year, has emerged as the biggest gainer so far this year, as investors lapped up beaten-down quality stocks from the space.

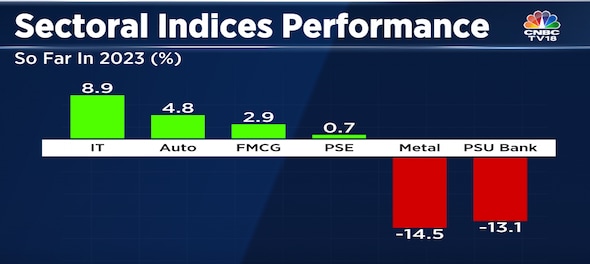

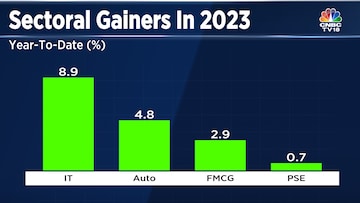

Between January and now, the gauge for IT stocks has outdone all sectoral indices on the NSE with a gain of 9 percent. That compares with a 1.6 percent drop clocked by the benchmark Nifty 50.

In fact, names like Tech Mahindra, Tata Consultancy Services, and HCLTech feature among the top performers on Nifty 50 so far, and along with Infosys, have contributed about 180 points to the benchmark index this year.

While a pullback rally in the Nasdaq stocks is mirroring a similar performance back in India, investors also find value in the space after a brutal selloff in 2022 where the index had witnessed the biggest yearly drop in 14 years.

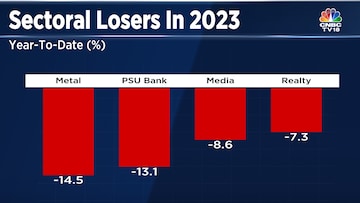

Interestingly, Nifty Metal and Nifty PSU Bank, the star performers of 2022 have declined the most so far in 2023. While the Metal index has declined over 14 percent, the index tracking state-run lenders has corrected 13 percent so far this year.

However, analysts remain cautious amid moderation in demand due to lower discretionary spending. "We expect demand for IT Services to bottom out in financial year 2024 and start picking up from financial year 2025 and 2026 amid structural tailwinds of cloud migration and digitalisation," ICICI Securities wrote in an investor note.

Despite the correction and the subsequent rebound, the IT sector continues to trade at a premium over the Nifty 50 index. The Nifty IT is currently trading at 24x financial year 2024 earnings, compared to the last 15-year average of 18x.

This is a 30 percent premium over the Nifty 50 price-to-earnings ratio of 18x against a historical average of 12x. The premium is also despite having financial year 2024 earnings per share (EPS) growth estimate of only five percent compared to the Nifty 50 EPS growth estimate of 14 percent.

(Edited by : Hormaz Fatakia)

First Published: Feb 21, 2023 5:47 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Rapido offers free rides to voters to polling stations on May 13 in Hyderabad, 3 other cities

May 6, 2024 5:49 PM

Lok Sabha elections 2024: Seats to date, all you need to know about third phase of voting

May 6, 2024 4:49 PM

Concerns on low voter turnout a "myth"; absolute number of voters correct way to analyse: Report

May 6, 2024 2:57 PM

Haryana Lok Sabha elections 2024: A look at JJP candidates

May 6, 2024 2:26 PM