Can a good time for a promoter or private investor to sell stock via a public offer also be a good time for investors to put money in the market? There isn’t an emphatic “yes” or “no” answer to that question. Empirical data points to a more nuanced conclusion.

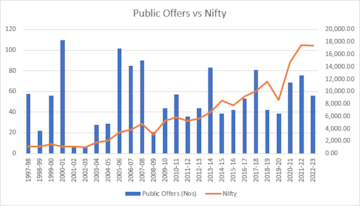

We looked at data from the Prime Database from the financial year 1996 till the the financial year 2023 along with that of the Nifty (S&P NSE-50 stock index) to try and get a fix on the relation. The findings are interesting, to say the least. Here are some key takeaways.

MARKET DOESN’T CARE FOR THE RUSH

The number of public offers coming to market has historically had little or no connection with market trends. The correlation of the number of public offers to the Nifty index has been a low 0.23. What this means is that a long line-up of public offers need not mean anything significant for the market. And that seems evident in the recent run-up in equity values, with the public offer market seeing a slew of new offerings, with little or no impact on the secondary market trend.

In fact, bigger transactions are happening in the block deal windows than via public offers.

Source: Prime Database

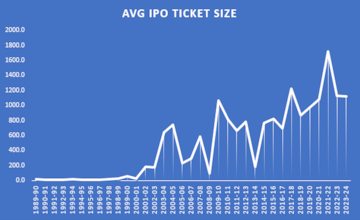

Source: Prime DatabaseWhat’s also interesting to note here, is that many of the public offers that have been coming to market recently are of relatively small companies looking to give exits to private investors and some liquidity to founders/promoters.

The average ticket size of public offers in the current financial year at nearly Rs 1,117 crore is lower than the average of Rs 1,222 crore in the financial year 2018, that’s five years ago.

If you look at that keeping in mind the time value of money, the present number looks even more diminished. And this is sharply lower than the average ticket size of Rs 1,716 crore in the financial year 2022.

Source: Prime Database

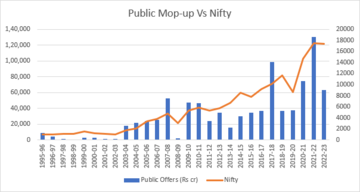

Source: Prime DatabasePUBLIC OFFER QUANTUM MATTERS

While the number of public offers doesn’t seem to faze the market. The picture changes quickly when you start examining the amount of funds being mopped up from the primary market.

Data over the years reveals that there is a very high positive correlation of 0.84 between the amount mopped up via public offers and the trend in the Nifty index. Both tend to climb together and peak out around the same time. It is debatable which one cues which, but the two tend to move in tandem.

Source: Prime Database

Source: Prime DatabaseA simple evaluation of data in the recent run-up suggests that the public offer quantum so far has not been off the order to ruffle things in the secondary market, but as the public offers get bigger and bigger sums to start getting pulled out, you could expect there will be a crescendo and a turn in the trend.

This is a time to stay invested, ride the rally and wait for the tide to turn.

(Edited by : Amrita)

First Published: Sept 17, 2023 12:01 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: Baramati to Mainpuri, key battles in phase 3

Apr 30, 2024 7:01 PM

From Amethi to Mumbai South — Lok Sabha seats where parties are yet to announce candidates

Apr 30, 2024 6:39 PM

Diamond rings, fridge, TVs: Bhopal voters to get exciting prizes to boost turnout in Lok Sabha polls

Apr 30, 2024 6:35 PM

This Bihar district has its own app to help voters during Lok Sabha election

Apr 30, 2024 4:02 PM