The combination of a slower economic growth rate, high-cost inflation, and a rise in interest cost means the Nifty earnings growth estimate of 18 percent for the financial year 2023 is at risk, according to Citi India.

"The consensus earnings expectations need to moderate from the current levels of 18 percent for FY23 and 15 percent for FY24," it said in a report.

Elaborating on the risks to Nifty earnings, Surendra Goyal, Head-India Research at Citi, during an interview with CNBC-TV18, said that while the expectation is that the numbers would be driven by sectors like consumer discretionary, auto, and financials, they tend to be volatile.

"With the rate scenario and with inflation, there are clear headwinds to both growth and margins," said Goyal, adding that the current earnings growth estimate of 18 percent for FY23 looks too high.

Goyal pointed out that over the last decade, barring a brief period of a year, India has generally started the year with high expectations of earnings, which could not be achieved. This implies that the risk to earnings has not been fully taken into account.

The quarterly GDP growth is likely to fall going ahead as the higher number expected in the April-June quarter was due to a low base and pick-up in economic activities, as per Goyal.

"The current data, macro data, activity data is quite strong and that is why for the April to June quarter, especially because of the favourable base, we are likely to see a GDP growth of maybe even 19-20 percent in this quarter. That is why the full-year GDP growth number, in our view, would be significantly elevated at around 8 percent," he explained.

Goyal, however, added that as we move in the year, the quarterly growth rates would fall quite substantially. "I think we will see numbers more or less in the 4 percent handle on GDP growth," he said.

Samiran Chakraborty, Chief Economist, India at Citibank, agreed and said that while FY23 GDP growth could be near 8 percent, it would taper in the coming quarters.

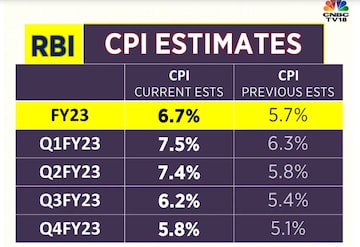

Citi India has also revised its average FY23 headline inflation forecast upwards to 6.9 percent from 6.6 percent earlier. It said that barring any "surprises" of lower food and fuel prices, it expects inflation to be above 6 percent for FY23. This is above the RBI’s inflation target of 4 percent.

"If it comes below 6 percent, RBI will have some breathing space. If it stays above 6 percent, monetary tightening might have to be more than what we are expecting now," said Chakraborty.

The central bank is required to maintain the CPI inflation at 4 percent, with some room to hit the upper limit at 6 percent and the lower limit 2 percent.

According to Citi, the average quarterly inflation could peak in the second quarter of FY23 at 7.6 percent. This is higher than the RBI's forecast of 7.4 percent for the second quarter.

The revised inflation forecast comes as experts expect the prices in the commodity space to largely remain elevated for a few months to a year with the food inflation unlikely to go down from the current levels as supply-side concerns remain amid the ongoing Ukraine-Russia war.

This would lead to the RBI announcing another 50 basis points rate hike in August with the peak rate at 6 percent by December 2022, according to Citi.

"While India property demand continues to be good, expected sharp hikes in policy rates will likely impact demand down the line," it said, hence moving real estate to 'neutral' call from 'overweight'. The company has removed Sobha from its preferred stocks.

While it has 'overweight' calls on financials, insurance, healthcare, etc. The firm has an 'underweight' rating on sectors like consumer staples, technology, and NBFC.

"If you see PSU utilities, while the growth outlook is modest... the valuations were attractive. The risks were a lot lower to earnings, and that is why we went ahead with the 'overweight' call," said Goyal.

On IT, Goyal said they were 'underweight' on the sector due to earnings risk and high valuations. "Even if you look post-correction, the sector is still trading at 20 to 23 times earnings," he said.

Similarly, valuations are still high in the consumer space amid the slowdown in the sector and pressures on raw materials.

Goyal said that while the Indian market was on the expensive side compared to its peers, rapid correction can make it attractive.

First Published: Jun 22, 2022 3:05 PM IST