The Nifty Bank Index has lagged behind the Nifty in recent times. However, when examining the returns over the last five to six years, the Nifty Bank has consistently outperformed the Nifty on a 10-year rolling basis. However, over the past year, the Nifty Bank index has seen a gain of under 2% compared to the Nifty's nearly 7% increase.

According to Vinit Sambre, Head of Equities at DSP Investment Managers, the banking sector's fundamentals remain solid, and it's only a matter of time before this is reflected in its performance.

"Maybe a quarter or two, once the concern around the peaking net interest margins (NIMs) goes away, I think that is where maybe the banking sector starts to do well," he told CNBC-TV18.

Fook Hien Yap, Senior Investment Strategist at Standard Chartered Bank anticipates continued strong economic growth over the next six to 12 months to bolster both retail and corporate loan growth. The robustness of balance sheets is also a positive sign.

"So in terms of the provisions, and the bad loans, which are out there, we think it's quite benign. And valuations are attractive. So we do have an overweight view for financials in India,” he said.

In September, experts from global financial services firm,

JPMorgan noted that the banking sector in India presents an attractive investment opportunity as they are one of the few sectors in the market where valuations remain acceptable, leading global financial services firm.

“Banks anyway, look great to us, because earnings growth is strong, it's probably the only sector in the market where valuations are acceptable so the core argument is still very strong for banks,” said Sanjay Mookim, Head of India Equity Research at JPMorgan.

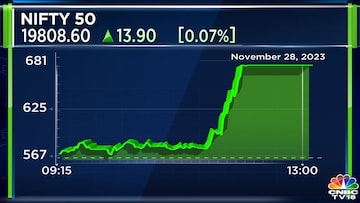

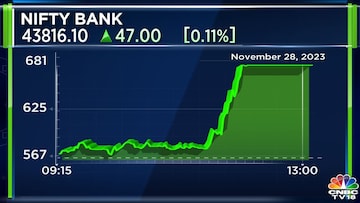

On Tuesday, November 28, the Nifty Bank had a choppier session when compared to the Nifty. Experts see 44,000 as a barrier for the banking index as it reversed from levels of 43,960 on Tuesday as well.

For more, watch the accompanying video

(Edited by : Shweta Mungre)

First Published: Nov 28, 2023 8:41 PM IST