The Nifty 50 index hit an all-time high of 18,908 in today's trading session. The index crossed its previous record high of 18,887.6, which it had made on December 1 last year. Since then, it has taken 142 trading sessions for the index to hit a new record high.

With this, the Nifty 50 index has now gained over 2,000 points in three months. The index has been in an uptrend ever since it reversed from its recent swing low of 16,828 on March 20 this year.

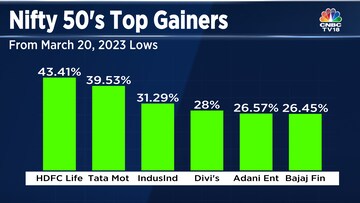

The Nifty 50 index has now gained 11 percent from its March 20 low. 48 out of the 50 index constituents have gained during this period. Among the top gainers since March 20 are Tata Motors, HDFC Life and Adani Enterprises.

The two underperformers since March 20 are Infosys (down 8.8 percent) and UPL (down 4.8 percent).

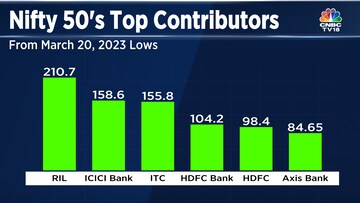

When it comes to point contributors that have led the Nifty 50's surge from the March 20 lows are Reliance Industries, which incidentally also has the highest weightage on the index, along with other heavyweights like ITC and ICICI Bank.

If we take a look at the timeframe from December 1 till date, Tata Motors and ITC emerge as the top gainers here as well, both having gained over 30 percent each. The Adani twins - Enterprises and Ports, along with Infosys are the top losers during this period.

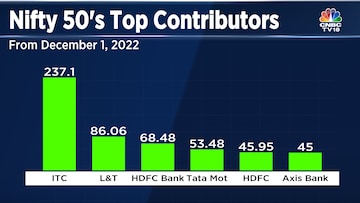

When you compare points contributions from December 1 last year, ITC still emerges as the top point contributor during this period for the Nifty 50 upside. Larsen & Toubro, Tata Motors are the other major point contributors.

On the other hand, Infosys and Adani Enterprises are among the top point contributors to the downside from the December 1 period.

Atul Suri of Marathon Trends PMS said that the Indian market will be the first few markets to reach a record high. He also said that there is another 15 percent potential upside in store for the index going forward.

Laurence Balanco of CLSA said that the Nifty 50 index is currently testing resistance in the 18,363 - 18,988 zone, which is provided by the highs in 2021 and 2022. He expects more uncertainty at higher leves and rangebound activities in the upcoming sessions.

"I don’t think that the market has that much steam to propel the markets much higher. This is not a expanding bull market, it is something that is likely to peter out in the medium term. So in the short term if the Nifty 50 were to go above 18,887, I see a maximum potential of about 19,350," Jai Bala of cashthechaos.com said.