MRF on Tuesday reported a net profit of Rs 119.5 crore for the April-June period, a decline of 29 percent compared with the corresponding period a year ago. The tyre maker's profitability was marred by high input costs amid sustained increase in raw material prices.

The revenue of MRF — a manufacturer and marketer of tyres and other rubber products — jumped 36 percent on a year-on-year basis to Rs 5,696 crore, according to a regulatory filing.

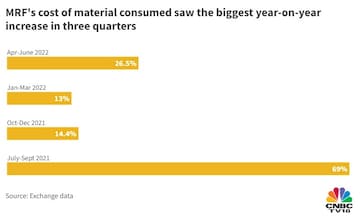

The company's total expenses jumped 37.3 percent to Rs 5,566.6 crore, primarily fuelled by input material costs. Its cost of material consumed increased 26.5 percent to Rs 4,114.1 crore, according to the filing.

The tyre maker's financial results come at a time when wild swings in commodity prices have posed margin pressure across sectors.

Its EBITDA — a measure of operating profitability — decreased 0.5 percent on year to Rs 493.4 crore for the three-month period.

MRF's EBITDA margin — a key metric that determines a business's operational efficiency — slipped by 320 basis points to 8.7 percent.

MRF's board gave nod to raising of up to Rs 100 crore through non-convertible debentures, according to a statement.

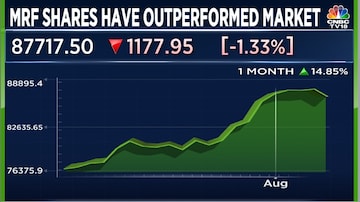

On Monday, MRF shares closed lower by Rs 1,136.6 or 1.3 percent to Rs 87,712.3 apiece on BSE, ahead of the earnings announcement. The stock, however, has outperformed the overall market in the recent past.

MRF shares have rewarded investors with a return of 14.9 percent in the past one month, a period in which the benchmark Nifty50 index has risen 8.1 percent.

Indian capital markets were shut on Tuesday on account of Muharram. Trading will resume on Wednesday.

(Edited by : Sandeep Singh)

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM