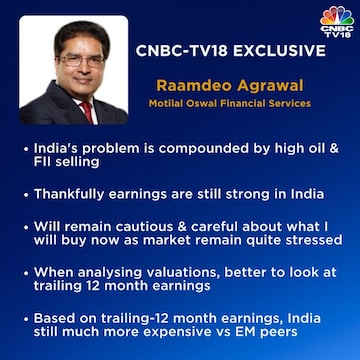

India is in a quandary, and high oil prices and unprecedented selling by foreign institutional investors (FII) amid global uncertainties have amplified the nation's problems, Raamdeo Agrawal, chairman and co-founder of Motilal Oswal Financial Services, told CNBC-TV18 in an interview.

"Till something changes in the current setup of the risks and challenges, the markets will remain stressed because our problem is directly coming from FIIs selling," he said, adding that he would remain "very cautious" in what he buys and at what price.

"I am fearless in terms of buying a good company at a reasonable price. But that's the challenge — all the good companies have gone through the roof. I won't hesitate to buy even now, but my expectation from the market, in the short run, would not be too optimistic," Agrawal said.

"I am surprised at the sheer number of about Rs 3 lakh crore of selling in the last 10-12 months. So, they (FIIs) own about 20 percent of the market. They have enough to sell if they want to," he said.

As per Agarwal, FIIs have the option of investing anywhere in the world, and he expects the pace of FII selling to continue if nothing changes. "This is a classic case where foreigners are selling out of India because they find it expensive, whereas Indians are lapping up all the stocks coming from the FII selling. This equation has to change," Agrawal explained. He felt one should look for stocks at reasonable prices.

Agarwal would like to be invested in service businesses at the moment rather than manufacturing. "Manufacturing is much more metal intensive, which is a

problem right now (due to export duties etc.). Whereas services have got more to do with the employee costs, interest costs, and those kinds of things, which is much more manageable," Agrawal said.

He said if someone is not overweight in the information technology (IT) space, they should not be underweight either.

"Rupee is going to remain at current levels or weaker if the uncertainty continues. In that situation, Indian IT could be at a place where there's a lot of pessimism thinking that there could be a recession in the US and things like that," Agrawal said. "At some point, Indian IT is going to be one of the most resilient high-quality sectors. That looks to be another place where I would put my money."

Among other sectors, he remains bullish on banking and insurance.

Watch the video for the full interview.