Shares of diagnostic chain Metropolis Healthcare Ltd fell as much as 1.4 percent to Rs 1,431.4 on Friday, a day after the company's chief executive officer (CEO) Vijender Singh was relieved from the post. The stock has been losing for the last two days and has fallen 1.31 percent in the period.

While Singh's last working day with the company was supposed to be November 30, 2022, the firm said in exchange filing that the company has agreed to release him from the position of CEO of the company and any other office or appointment held by him with effect from the closing of business hours of Wednesday (August 17, 2022) and to waive his balance notice period.

Singh had resigned from his position of the Chief Executive Officer on July 29, but was asked to continue till November 30, 2022.

The company said in its statement that it has appointed a Talent Search Agency for finding a suitable candidate for the position of CEO.

Prior to Metropolis Healthcare, Singh served as the chief operating officer of Dr Lal’s Pathlabs and has held executive positions at Bausch & Lomb and Ranbaxy Labs.

Reports suggest that the former diagnostic chain CEO has joined India-focused growth private equity firm Jashvik Capital as an operating partner.

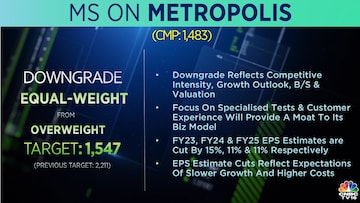

Brokerage house Morgan Stanley has downgraded the rating to 'equal-weight' from 'overweight' on the shares of Metropolis with a target price of Rs 1,547, cut from Rs 2,211. According to MS, a focus on specialised tests and customer experience will provide a moat to the company's business model.

FY23, FY24, and FY25 EPS estimates are cut by 15 percent, 11 percent and 11 percent respectively. These cuts reflect the expectation of slower growth and higher costs.

First Published: Aug 19, 2022 10:49 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha polls: Polling time in Telangana increased by an hour, here's why

May 2, 2024 6:55 AM

Prajwal Revanna Sexual Assault Case: Activist raises concerns over political interference, delayed investigation in the matter

Apr 30, 2024 10:17 PM

Lok Sabha Election 2024: Baramati election outcome will decide the future of Pawar dynasty, says expert

Apr 30, 2024 10:08 PM

Lok Sabha elections 2024: Baramati to Mainpuri, key battles in phase 3

Apr 30, 2024 7:01 PM