On Monday, the shares of AMC Entertainment shot up 18 percent. The week before last, it had surged nearly 150 percent in a day. Rally in AMC Entertainment and a fresh batch of meme-stocks has breathed fresh life into a frenzy that first began in January 2021 when the shares of video game retailer GameStop surged over 1600 percent in a month.

Last week, Shares of Chamath Palihapitiya-backed Clover Health Investments soared as much as 110 percent. Then, Clean Energy Fuels Corp rose 32 percent on Wednesday. In Europe, Air Berlin jumped nearly 140 percent, after surging 55 percent the previous day.

ALSO READ |

First up, what are meme stocks?

While there is no clear definition of meme stocks, these stocks are known to disregard the underlying fundamentals and gain as the social media hype instils FOMO (fear of missing out) into investors.

One common trend in all meme stocks is that the stocks of the companies make money by share certificate, rather than the product or service they specialise in.

Take AMC Entertainment, for example. The world's largest theatre chain has made more money selling share certificates this summer than movie tickets. While the non-existent ticket sale is understandable, this sheer fact should hold back investors from flocking around it.

The reason behind these eye-popping rallies

It all comes down to Social media > Reddit > WallStreetBets.

WallStreetBets is a popular Reddit forum that consists of retail investors. These investors are fundamentally against the fund managers who short stocks to profit from them.

The chatter builds on this Reddit group and other social media platforms about the potential for short squeezes as investors in the forums rally against short sellers.

Since the broader market hasn't gone anywhere for most of the month gone by, the speculative frenzy became even more pronounced.

The life-cycle of a meme stock

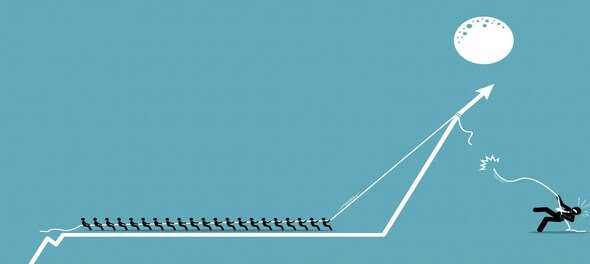

Companies become meme stocks because Redditors want to get back at hedge fund managers shorting them. So when they buy, the stock goes up, fund managers lose money and even more retail investors pile in. Let's see this with an example:

— A company exists. A theatre line, a video-game store, or a car rental company.

— Things get tough. Theatres don't open in the pandemic, video games go online, or firm files for bankruptcy.

— The stock plunges. And fund managers sell it short.

— WallStreetBets start buzzing. They decide: 1) stock is undervalued, 2) fund managers should be punished, 3) take the stock to the moon.

— Retail investors then start buying the stock. Short sellers panic.

— Analysts suggest the stock is away from its fundamentals.

— Every time someone criticises, Redditors send the stock even higher.

"Companies don’t become meme stocks because Redditors endorse a widespread consensus that they are good operators in attractive markets. The way to become a meme stock is to be bad, then good," Matt Levine wrote for Bloomberg.

(Edited by : Abhishek Jha)

First Published: Jun 15, 2021 4:33 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

2024 Lok Sabha Elections | Will Amethi and Rae Bareli see the rise of Priyanka Gandhi as a dominant political figure

May 18, 2024 8:59 AM

Lok Sabha Election 2024: I.N.D.I.A. bloc to hold rally at Mumbai's BKC today

May 17, 2024 5:18 PM

In Ayodhya, voters talk of a promise fulfilled and yearning for development

May 17, 2024 2:10 PM

Fight of heavyweights in Sambalpur where farmers, weavers hold the key

May 17, 2024 12:25 PM