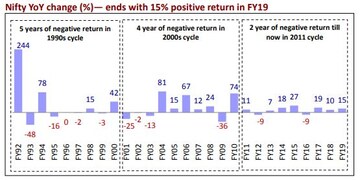

Brokerage firm Motilal Oswal on Thursday said that Indian markets remained stable in FY19 as Nifty rallied 7.7 percent in March to close at 11,624 after three years, supported by strong flows from foreign portfolio investors.

In its research report, Motilal Oswal said the supportive factors for Nifty's rally were a deluge of FII (foreign institutional investors) flows and rising confidence of National Democratic Alliance (NDA) making a comeback in the upcoming general elections.

Graphic: Motilal Oswal

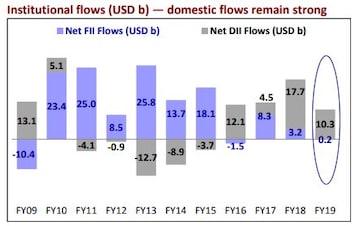

Graphic: Motilal OswalIn the month of March, FII flows were the highest at $4.8 billion while Domestic institutional investors (DII) sold $2 billion. Meanwhile, Indian macros have been stable, with currency, crude oil and 10-year bond yields moving in a narrow range, it added.

Graphic: Motilal Oswal

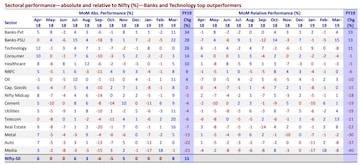

Graphic: Motilal OswalAccording to the brokerage, among sectors, private banks rallied the most in FY19, with 34 percent followed by PSU banks that surged 28 percent. The worst performing sectors were media (-25 percent), autos (-22 percent) and metals (-15 percent), the report said.

Meanwhile, among stocks, top performers were Bajaj Finance (71 percent), Reliance Industries (54 percent) and Axis Bank (52 percent) while worst performers were Vedanta (-14 percent), SBI (-8 percent) and Hindalco (-6 percent), it added.

Graphic: Motilal Oswal

Graphic: Motilal OswalMotilal Oswal expects that the near-term direction of the market will be decided by the developments in the political front.

"After four tepid years in the banking sector, expect better profits and the return on equity (RoE) recovery in the corporate banks," said the brokerage firm.

IT sector will continue its sustained earnings growth, favourable deal activity and reasonable valuations, it said, adding that auto sector will remain weak while Reliance Industries will see limited upside.

In LargeCaps, Motilal Oswal prefers ICICI Bank, Axis Bank, Titan, Maruti Suzuki, Bharti Airtel, Infosys, M&M, Coal India and SBI. In MidCap, they are betting on LIC Housing Finance, Federal Bank, DCB, Godrej Agrovet, Indian Hotels, Page Industries, Crompton Consumer, Oberoi Realty, Ashoka Buildcon and M&M Financial Services.

First Published: Apr 4, 2019 9:46 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

In Andhra Pradesh's silk hub, weavers' cry for help echoes through election season

May 3, 2024 12:24 PM

Feroze Gandhi to Rahul Gandhi: Rae Bareli's tryst with Congress

May 3, 2024 11:36 AM

Rahul Gandhi to contest from Raebareli, close aide KL Sharma from Amethi

May 3, 2024 8:39 AM

BJP's Hindi heartland dominance faces test in phase 3 polls

May 2, 2024 9:14 PM