The Indian stock market witnessed a notable surge as the BSE Sensex, Nifty 50 and Midcap Index reached record closing highs.

BSE Sensex climbed up by 195 points to close at 63,523, while the Nifty 50 recorded a gain of 40 points, closing at 18,857.

The banking sector also witnessed a significant upswing, with the Nifty Bank surging 93 points to reach 43,859. Additionally, the Midcap Index soared by 285 points, settling at 35,614.

The Midcap Index, in particular, demonstrated its robust performance by posting a record close for the 12th consecutive session.

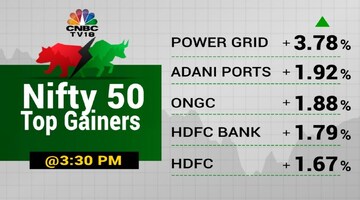

The top gainers on the Nifty 50 were Power Grid Corporation, ONGC, HDFC Bank, Adani Ports and HDFC. While the top losers on the Nifty 50 were JSW Steel, Hindalco Industries, M&M, Divis Laboratories and ITC.

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services said, "Sectorially it was a mixed bag with major buying seen in financial services, especially NBFC. Consistent foreign inflows into Indian equities backed by the country's strong macroeconomic data have driven investors’ confidence. Primary market is getting back in action with two mid-sized IPOs opening for subscription next week – Ideaforge Ltd & Cyient DLM Ltd. In the near term, all eyes would be on the US Federal Reserve Chair Jerome Powell’s two-day testimony before Congress, which began today (Wednesday). It would indicate the Fed’s future course of action with regard to the interest cycle. Also, BOE would announce its policy decision tomorrow (Thursday) where a 25bps hike is expected. PM Modi’s four-day visit to the US began today (Wednesday) when he met the Top CEOs and tomorrow he would be addressing US Congress, which could further strengthen the Indo-US partnership,"

On the sectoral front the metal index was down nearly 1 percent, the FMCG index was down 0.4 percent and the realty index was down 0.3 percent, while the power index was up 1 percent and the oil & gas index rose 0.5 percent.

In the pharmaceutical sector, Lupin shares surged up to 7 percent following the company's achievement of US FDA approval for its Spiriva generic.

Piramal, on the other hand, posted its biggest gain in three years after successfully raising a substantial amount of Rs 4,800 crores through the sale of its Shriram Fin stake.

The market also witnessed a notable development in the Shriram Fin stock, which gained over 11 percent after Piramal sold its entire 8.3 percent stake.

Shares of Zee Entertainment closed slightly lower, with a 5 percent decline from its highs, as market participants closely monitored court developments involving Sony.

Positive news from Europe's healthy auto sales growth lifted Motherson's stock by 4 percent. Meanwhile, LIC Housing Finance experienced a 4 percent increase in its stock value, accompanied by substantial trading volumes.

IGL, the leading provider of compressed natural gas (CNG), witnessed a 3 percent gain as the Delhi government extended the permissible usage of CNG for taxis to 15 years.

Metal stocks faced downward pressure due to global cues, resulting in a 2 percent decline in the stocks of JSW and Hindalco.

Divi's Laboratories encountered a minor setback, with a decline of over 1 percent following the release of negative notes by two brokerages.

HDFC Asset Management Company (AMC) witnessed profit booking after experiencing a sharp upward movement on Tuesday. Bandhan Bank shares declined over 2 percent as the impact of floods in Assam affected 19 districts.

Also read: Stock Market Live: Sensex, Nifty 50 off lows, financials lead gains, FMCGs under pressure

First Published: Jun 21, 2023 3:46 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Telangana CM violated poll code, defer Rythu Bharosa payment, says Election Commission

May 7, 2024 9:01 PM

Lok Sabha Election 2024: How Indian political parties are leveraging AI

May 7, 2024 6:59 PM