Mark Matthews of Bank Julius Baer & Co. sees value in the Indian equity market despite the steep run-up in major indices. "While midcaps appear overpriced, the broader market remains reasonably valued, aligning with its long-term average of around 25 times price-to-earnings," he said in a chat with CNBC-TV18, adding that he would be a buyer in the Nifty today if he didn't already hold positions in it.

Matthew believes there is scope for another 10-15% rally in the market next year given that earnings have the potential to grow in the mid-teens.

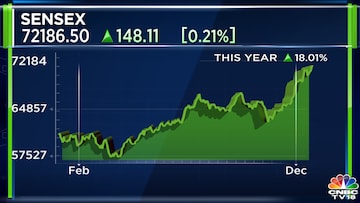

On December 27, the Indian stock market reached new heights, breaking records despite a bumpy ride in the market. The Sensex, Nifty, and Nifty Bank, three major stock indices, all hit all-time highs, contributing to the combined value of BSE-listed companies reaching an impressive $4.3 trillion.

The Sensex closed at an impressive 72,038, marking a substantial gain of 702 points. Similarly, the Nifty experienced an upswing of 213 points, settling at 21,655. The Nifty Bank recorded a significant rise of 557 points, reaching 48,282, and the midcap index saw a gain of 171 points, concluding at 45,559.

With this, The Nifty 50 is up close to 20% this year, marking its second-best annual performance since 2017. The index is set for its eighth straight annual performance. The only year since 2012, in which the Nifty has delivered negative returns is 2015.

Matthews does not expect a recession in the US. "We're not thinking there's going to be a recession, we do think a deceleration in growth is entirely likely given that interest rates have gone from zero to 5% in a very short period of time. So I think that for US economic growth, we're only forecasting about 1-1.5% next year, but that's still positive growth. And it's the second half of the year where we're likely to get an expansion in the activity and then moving into 2025 probably back to about 3% or so," he said.

Also Read

For the entire interview, watch the accompanying video

(Edited by : Shweta Mungre)