The overall economic conditions in India are highly favourable, as reflected in the market's positive trajectory, noted Manish Chokhani, Director of ENAM Holdings.

"Expectations are running high and we are priced for pretty much perfect execution and goldilocks scenario continuing, so that risk always remains. However, the big balance sheets of India, whether it is corporate sector

banking sector, government, are all in the right direction. So no real reason to say that we should have a big setback. Also the big indices are not overvalued, so there is nothing yet in the large caps to suggest that Indian stock markets are approaching a climax," Chokhani stated in an interview to

CNBC-TV18.The

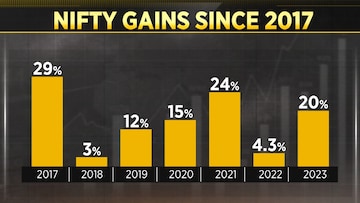

Nifty 50 concluded 2023 with a 20% gain, marking its eighth consecutive year of positive returns. Notably, the index has maintained positive annual returns every year since 2015, with the year being the sole exception, experiencing negative annual returns.

Chokhani suggests that the current market valuations in India do not account for unforeseen developments. He advises investors to reserve some resources to capitalize on potential corrections, advocating for a more tempered outlook on expectations. Despite this caution, he acknowledges India's enduring bull market.

Highlighting the recent dynamics in the banking sector, Chokhani observes a shift where PSU banks are gaining momentum. He anticipates the banking sector to reclaim its leadership role in the market.

Expressing reservations as a value investor, Chokhani acknowledges the excellence of new-age companies but finds it challenging to justify paying premium prices for an extended period of flawless execution and limited competition.

Regarding government actions, Chokhani appreciates the lack of significant budgetary changes, deeming it appropriate. However, he anticipates significant policy initiatives when a new government takes charge, particularly emphasizing the potential for

privatization.

Chokhani also echoes the call to stop taxing dividends twice, emphasizing the importance of avoiding substantial changes to capital gains tax to maintain a positive market sentiment.

Watch accompanying video for entire conversation.