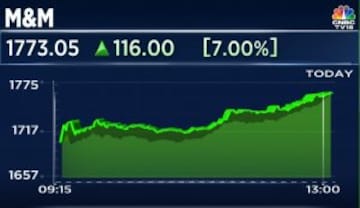

Shares of Mahindra & Mahindra (M&M), which are witnessing a classic clash between the bulls and the bears following the auto major's third-quarter performance, opened 4% higher in trade Thursday. M&M's Q3 results were in-line, driven by a strong growth in the SUV segment.

At 9:22 am, the

M&M stock was trading 4.46% higher at

₹1,731 per share and was the top Nifty performer. M&M shares closed at ₹1,662 on February 14 after the results, up nearly 1% from its previous close on the NSE. In a little over three months, the stock has given a return of nearly 14%.

In the bullish camp, analysts from CLSA, Nomura, Morgan Stanley and HSBC advocate for M&M while Jefferies remain bearish. CLSA has a 'Buy' stance on the counter with a target price of ₹2,074, while Jefferies has a 'Hold' rating with a target of ₹1,615.

Among others, Nomura maintained a 'Buy' on the M&M stock with a target price of ₹2,143. HSBC also echoed a 'Buy' rating, with a target of ₹1,900. Morgan Stanley rated the stock as 'Overweight' with a target of ₹1,952.

| Brokerages | View | TP |

| CLSA | Buy | ₹2,074 |

| Nomura | Buy | ₹2,143 |

| Morgan Stanley | Overweight | ₹1,952 |

| HSBC | Buy | ₹1,900 |

| Jefferies | Hold | ₹1,615 |

Here's what brokerages recommend:

CLSA is positive on the counter on the back of strong SUV growth. The brokerage said that SUV bookings have declined with a ramp up in production. On the tractor segment, CLSA expects the volumes to decline 5-6% year-on-year in FY24.

Nomura said M&M's strong Q3 earnings growth was driven by SUVs despite weakness in tractors. The brokerage is quite optimistic of the structural growth of SUVs in India and strong positioning of M&M. Not just that, Nomura said the company's SUV and electric vehicle model cycle is strong, its order book of 5-6 months gives visibility, and the company's growth will remain well ahead of the industry.

According to HSBC, the passenger vehicle market share gains are likely to continue in FY25. The tractor business, muted for two years, could stabilise but monsoons are key for demand, the broking firm noted.

HSBC also said that an extended El Nino in FY25 and a slowdown in SUV momentum are key risks for the company.

Morgan Stanley expect M&M's tractor business decline rate to trough out in March 2024. The global brokerage also believes that a strong SUV vertical will support growth. Morgan Stanley also expects a 13% YoY growth in FY25 as against its guidance of mid- to high-teens growth.

Jefferies, on the other hand, said the stock is not cheap and is unlikely to deliver meaningful returns until tractor demand visibility improves. The brokerage said the slowdown in the tractor segment is intensifying after an elongated upcycle.

First Published: Feb 15, 2024 10:02 AM IST