Market veteran Madhu Kela, founder of MK Ventures, on Wednesday said that now is a good opportunity for investors to build a portfolio owing to the current macro conditions which have led to a correction in the market.

"Because of the macros, these corrections have happened and now is a chance to build what you want to buy over the next three, four months till the time the noise settles because when the noise settles and once everyone knows that the macro is under control, obviously these prices will not stay," he said in a conversation with CNBC-TV18.

Kela said he has more conviction to invest in the market today than he had six months ago, with his favourite sector being financials.

"If you look at the overall performance of banks, the private banks have delivered 23 percent negative returns in the last three years. Similarly, if you look at the PSU banks, they have been almost flat as a basket because SBI has been a big performer... In the last eight years, there has been unprecedented amount of clean-up which has happened from the banking sector," he said.

Kela added that PSU banks have made provisions of Rs 12.9 lakh crore while private banks have made provisions of Rs 3.9 lakh crore in the last eight years. He prefers State Bank of India, Canara Bank and Bank of Baroda among PSU banks and ICICI Bank in the private lenders' space.

Read Here

Among the other spaces they are investing in are manufacturing companies, engineering, procurement and construction (EPC) companies and midcap pharma companies.

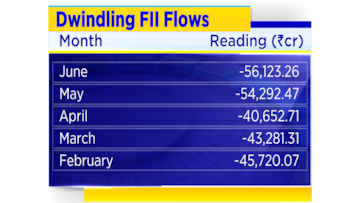

According to him, a large part of the foreign institutional investors' selling seems to be over and some FIIs may look to buy, following a sharp correction seen in the currency market.

"If you see a one month back, the number (FII selloff) used to be Rs 5,000 crore, Rs 6,000 crore, Rs 7,000 crore a day. Now it has fallen more reasonably. Last maybe 15-20 days, the average (selling) would be Rs 1,500-2,000 crore," he said.

"We are entering a very good cycle and we are at the very early stage of this cycle," he added.

Watch video for more