The Indian market, taking cues from the overall global macro environment, has fallen sharply in recent times. In the past month, the benchmark indices, Nifty50 and BSE Sensex, have been down 4.75 percent and 4.4 percent, respectively. However, market veteran Madhu Kela, founder of MK Ventures, believes that the tailwinds will blow always sooner than later, and there may be a positive earnings surprise in store.

“After a 15 percent growth in Nifty EPS in FY21 – the first double-digit growth in a decade – earnings are likely to grow 35 percent in FY22. The (market) consensus is expecting 19 percent growth for FY23, led by BFSI (banking, financial services and insurance), oil and gas, and IT segments,” he says.

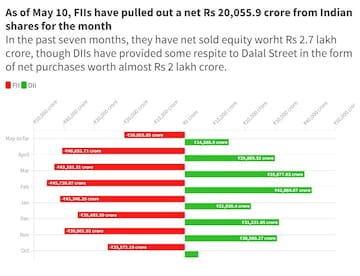

Foreign investors have been

pulling out of the market, and foreign institutional investors (FIIs), which used to be roughly 22.5 percent of the overall market cap, have fallen to below 20.5 percent.

"While there has been such a significant outflow from the secondary market, FIIs have put roughly Rs 1 lakh crore in the primary markets," Kela said.

“If you consider the global financial crisis, the outflow of the FIIs was not so significant. What I am trying to say is that the markets are far more resilient this time because on a significantly higher outflow at that time, markets tanked more than 50 percent. This time, while the outflows are significant, the markets are only down 15-16 percent from the peak,” he added.

What should investors do in the current scenario? Kela believes that this is a time to conserve money and have moderate expectations.

Comparative performance

The correction in other broader global indices has been more than the Nifty and Sensex, our benchmark indices. “Nifty has been one of the best performing indexes globally,” said the market veteran.

The road ahead

Speaking on the macro environment, Kela said the high inflation, which hit 7.79 percent in April, should cool down in the next few months.

“Inflation expectation will be tamed down significantly over the next 3-4 months. So, governments will do whatever it has to do to tame inflation, and we have to be careful. Whenever the excessive amount of money is being made, and it falls into the radar, we have to be careful about investing,” he said.

(Edited by : Abhishek Jha)