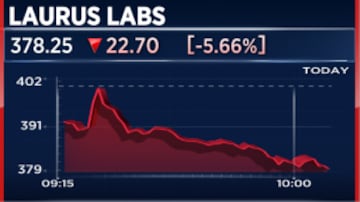

Laurus Labs shares declined more than 7% on Monday, October 23, after analysts projected a downside of up to 35% for the stock over the next 12 months.

The pessimism was triggered by the disappointing earnings reported by the Hyderabad-based company, which makes active pharmaceutical ingredients, a key input that goes into making medicines. This was the third straight quarter the company saw its revenue shrink.

Global brokerage Jefferies has assigned an 'Underperform' rating on

Laurus Labs with a target price of ₹260 per share, implying a downside of 35% from Friday’s close.

Another brokerage Kotak Institutional Equities assigned 'Sell' rating on the stock with a target price of ₹270 per share. That's 32% less than Friday’s closing price. The analysts also called the earnings 'insipid'.

Laurus Labs shares dropped by as much as 7.31% to hit a low of ₹370.40 on BSE in early trade on Monday.

This was the fifth time in a row that the earnings from Laurus Labs had been less than what the street had expected, Jefferies said, explaining the rationale for its

bearish projections i.e. a 33% cut in earnings estimate for the current financial year, and a 5% cut in the estimate for the next one.

Post these cuts, Jefferies' estimates are less than the average estimate of all analysts by anywhere between 11% and 30%.

Jefferies expects only a gradual ramp-up in new contract, development, and manufacturing (CDMO) business, which made about 18% of the company's revenue in the last quarter. This segment was particularly hit by the falling sales of the Paxlovid, a drug used to treat COVID-19 patients.

The sales of Paxlovid was expectedly high in the previous years due to the pandemic. However, now that the infections have receded, the sales have gone down too. The CDMO segment, which made Paxlovid, saw a 69% fall in revenue.

The revenue growth may be better in the second half of the financial year ending March 2024 but the profit margin may face some headwinds, Kotak Institutional Equities said.

The report also worried about the lack of visibility of any other commercial CDMO contract, while calling the two-year long weakness in the core business “certainly unsettling”. Laurus Labs last week announced a 23% year-on-year fall in revenue to ₹2,406 crore for the September quarter. Operating profit dropped 61% on-year to ₹356 crore in the quarter.

One set of analysts disagree though

However, Mirae Asset is still bullish on the company. The analysts called the recovery in both revenue and profitability, compared to the preceding three months, was impressive and the momentum is likely to continue.

While Mirae also cut the earnings estimate for the current financial year by Rs 6 per share, it retained the rating at 'add' and set the target price at Rs 455, 13% higher than Friday's closing price. "This could act as a possible inflection point for Laurus. Improving growth prospects across all segments, capacity expansion plan to support the CDMO business, off-patent drug opportunities are the key positives for Laurus," analysts at Mirae Asset said.

Speaking to CNBC-TV18 on Monday, Satyanarayana Chava, Founder and CEO of Laurus Labs said, "The only one division which is the one we are very bullish, but we need to have patience on the CDMO division. CDMO division has recorded less sales compared to the corresponding quarter last year."

Gross margins will definitely remain similar but Chava expects higher sales in the second half. "We are very confident that H2 will be definitely much better than H1 both topline as well as EBITDA numbers."

Laurus Labs shares 6.94% down at ₹371.90 on BSE at 10.30 AM.

First Published: Oct 23, 2023 11:03 AM IST