Shares of KPIT Tech are trading lower for the second day in a row after brokerage firm Kotak Institutional Equities projected the stock to fall 42% over the next 12 months.

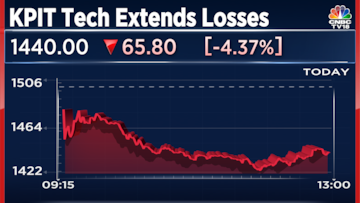

The stock fell as much as 5.8% to 1,417 after Tuesday's 7.3% fall. With this, the stock has declined over 12% in the last two trading sessions. It is also the top loser on the Nifty Midcap index. The stock has been in the red for four out of the last seven trade sessions.

The brokerage on Tuesday set a target price of ₹940 per share, indicating a downside of 42% from the previous close of ₹1,622.3 apiece on Monday.

The software stock has gained 24.3% in the past month, 54% in the last six months and 105.6% this year, so far.

The KPIT Stock was trading 4.8% lower at Rs 1,433.25 apiece at 12.40pm on Wednesday, November 23.

Gurmeet Chadha, the managing partner and CIO at Complete Circle, said that to him, digitisation of cars, electrification of cars is a very long-term theme and KPIT keeps popping the guidance in a tough environment like this. "They do one part of what Tata Technologies does," Chadha said, adding that its a "good marriage" if one wants to play the complete automative value chain, they should propbably have both Tata Technologies and KPIT Tech in their portfolio.

The initial public offer (IPO) of Tata Technologies was fully subscribed within the first hour of the issue opening for subscription to the public earlier today.

Last month, the company raised its financial year 2024 revenue growth guidance in constant currency terms.

For the full financial year, the company now expects revenue growth of 37% in constant currency terms, from the earlier guidance, which ranged between 27% and 30%.

Additionally, the company has also raised its operating profit or EBITDA guidance for the year to more than 20% from the 19-20% range earlier.

For the September quarter, KPIT Tech reported revenue growth of 9.2% sequentially to ₹1,199.1 crore from ₹1,097.6 crore in June. Net profit increased by 5.1% to ₹140.8 crore. The base quarter also had a one-time gain of ₹13.4 crore, excluding which, the net profit growth would be 16.8%, according to the company.

Operating profit or EBITDA grew 12.1% to ₹239.8 crore, while EBITDA margin grew by 50 basis points to 20% from 19.5% in June. The company managed to grow margin by 50 basis points after the full-quarter impact of wage hikes, which had a gross impact of 250 basis points. This was offset by revenue growth and improvement in net realisations.

Also Read: CG Power shares surge to record high as it seeks approval to set up semiconductor assembly unit

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM