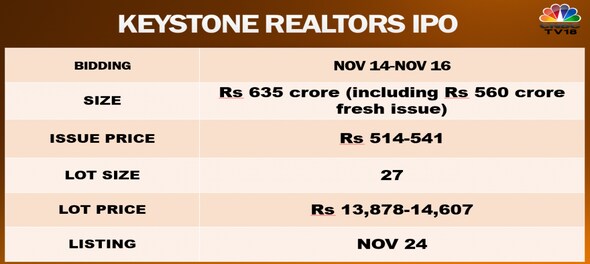

Keystone Realtors' IPO worth up to Rs 635 crore hit the Street today (November 14). The initial share sale of the Mumbai-based realty developer, which operates the Rustomjee brand, includes fresh issuance worth Rs 560 crore and an offer for sale (OFS) for the remainder. The IPO will be available for bidding from 10 am to 5 pm for three trading days till November 16.

Keystone Realtors shares are likely to be listed on stock exchanges BSE and NSE on November 24.

Here are some key details about the Rustomjee IPO:

Important dates: The basis of allotment is likely on November 21, and the crediting of shares to demat accounts on November 23.

Issue price: Keystone Realtors shares will be available for bidding in a price range of Rs 514-541 apiece under the IPO.

Lot size: Potential investors will be able to bid for Keystone Realtors shares in multiples of 27 — which translates to Rs 13,878-14,607 per lot.

Investor reservation: Up to 50 percent of the total issue is reserved for qualified institutional buyers, at least 15 percent for high net worth individuals and the remaining for retail investors.

Financials: Keystone Realtors revenue returned to pre-COVID levels in the year ended March 2022.

Keystone Realtors Chairman and Managing Director Boman Rustom Irani told CNBC-TV18 the funds raised will be utilised for new projects. The company aspires for Rs 700 crore of revenue from the affordable housing segment, he said.

Should you subscribe to the Keystone Realtors IPO?

Choice Broking recommends subscribing to the issue with caution. The company is demanding an embedded value-to-pre-sales (TTM) multiple of 2.6 times at the upper end of the price range, which it believes is at a discount to its peers.

KRChoksey pointed out that Keystone Realtors' average price-to-earnings multiple stands at 96.5 times.

First Published: Nov 14, 2022 9:43 AM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna Sexual Assault Case: Activist raises concerns over political interference, delayed investigation in the matter

Apr 30, 2024 10:17 PM

Lok Sabha Election 2024: Baramati election outcome will decide the future of Pawar dynasty, says expert

Apr 30, 2024 10:08 PM

Lok Sabha elections 2024: Baramati to Mainpuri, key battles in phase 3

Apr 30, 2024 7:01 PM