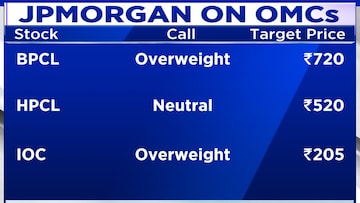

State-owned oil marketing companies (OMCs) are in focus after a recent note from JPMorgan. The global investment major has raised target prices for three major players:

Bharat Petroleum Corporation Ltd (

BPCL), Indian Oil Corporation Ltd (IOCL), and Hindustan Petroleum Corporation Ltd (HPCL).

In its analysis, JPMorgan highlights the impact of fluctuating crude oil prices on the performance of these companies. In January, there was a noticeable increase in crude oil prices, followed by a further rise of approximately $5.50 per barrel in February. This upward trend initially boosted stock prices.

They say crude is still at December quarter averages. In addition, the fear is that diesel or petrol prices will be reduced, although that hasn't happened yet, which is protecting their marketing margins. JPMorgan also added that the consensus EPS estimates for FY24 are still very low. Hence, there is a possibility of an upside.

As a result, JPMorgan suggests that unless there are significant changes in crude oil prices or retail fuel pricing strategies, the outlook for OMCs may remain stable. They anticipate a continued upward bias in stock prices for these companies.

JPMorgan has adjusted its target multiples for enterprise value (EV) to earnings before interest, taxes, depreciation, and amortization (EBITDA) from five to six times for all three stocks. Additionally, they maintain a preference for BPCL, followed by

HPCL, and have accordingly revised their target prices: BPCL to ₹720, HPCL to ₹520, and IOCL to ₹205.

JPMorgan continues to recommend an 'overweight' position on BPCL and

IOCL within investment portfolios, reflecting their positive outlook on these companies' future performance.

(Edited by : Ajay Vaishnav)