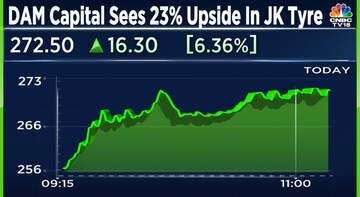

The shares of India’s third largest tyre manufacturer JK Tyre and Industries Ltd jumped nearly five percent in trade on Wednesday after investment bank DAM Capital Advisors Ltd took a bullish stance on the stock.

DAM Capital initiated coverage on JK Tyre with a ‘buy’ rating and a target price of Rs 315 apiece, hinting at an upside potential of 23 percent from the stock’s previous close of Rs 256.05 on BSE.

The investment bank said that JK Tyre is steadily gaining market share during the last 2-3 years and is witnessing improvement on all operational fronts. It added that the recent focus on premium categories, with new launches in the passenger vehicle segment, is a positive for the company.

Reacting to the development, shares of JK Tyre gained as much as 4.9 percent to hit an intra-day high of Rs 268.65 on BSE on Wednesday. The stock has seen a sharp rally in the past six months, surging almost 85 percent during this period, on the back of strong financials.

For the last quarter ended June 2023, JK Tyre’s profit after tax (PAT) increased over 310 percent on a year-on-year basis to Rs 154 crore compared to Rs 37.2 crore in the same quarter last year.

However, the company posted a marginal 2.1 percent growth in its revenue from operations at Rs 3,718.1 crore for the June quarter as opposed to Rs 3,643 crore in the corresponding quarter last year.

Operating profit, or EBITDA, saw a sharp rise of 60.6 percent to Rs 457.3 crore in the first quarter from Rs 284.8 crore in the year-ago period. EBITDA refers to earnings before interest, tax, depreciation and amortisation.

Optimism around JK Tyre is also stemming from the positive sentiment for the Indian tyre industry. According to a recent report by the Automotive Tyre Manufacturers’ Association (ATMA), India’s tyre industry is on course to more than double its revenue to $22 billion by FY32 from $9 billion in financial year 2022.

The primary drivers are the rising demand for vehicles in the country and continuous government investments in infrastructure.

India is also expanding its presence in the premium and luxury tyre segments, dominated by imports, according to a study by CRISIL Market Intelligence and Analytics (MI&A) Consulting.

(Edited by : Asmita Pant)

First Published: Sept 20, 2023 11:20 AM IST