Financial year 2024 saw 75 companies have their IPOs. These 75 companies raised over ₹61,000 crore, according to data from Prime Database. On a year-on-year basis, this figure is up 19%. But one must keep in mind, that the previous year had a mega IPO, that was of LIC. So excluding LIC, that 19% figure goes up to 58%.

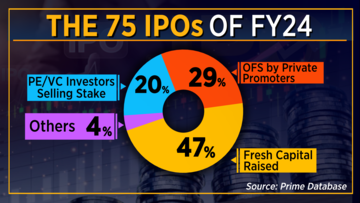

The markets scaled one new peak after another after bottoming out last march. The promoters and early investors chose to take some money off the table. And hence, this is the result. 20% of the funds raised came from private equity and venture capital selling shares in the IPO. 29% came via promoters selling stock via the offer for sale component.

Still, 47% or nearly ₹29,000 crore were raised in financial year 2024 through a fresh issue of equity shares. That number in percentage terms, is the highest level in seven years.

But how did these companies use the funds that they raised?

Remember we highlighting a few months ago that debt reduction was one of the key reasons why companies went public and raised fresh capital? That still is one of the major factor. But one-third of the funds raised were used for working capital requirements, debt repayment comes a close second followed by capex and some other factors.

Now the markets going up immediately reflects in investor sentiment. This IPO subscription chart is proof. 22 out of the 75 IPOs of the year saw subscription in excess of 50 times. 32 of them were subscribed between 10 times to 50 times.

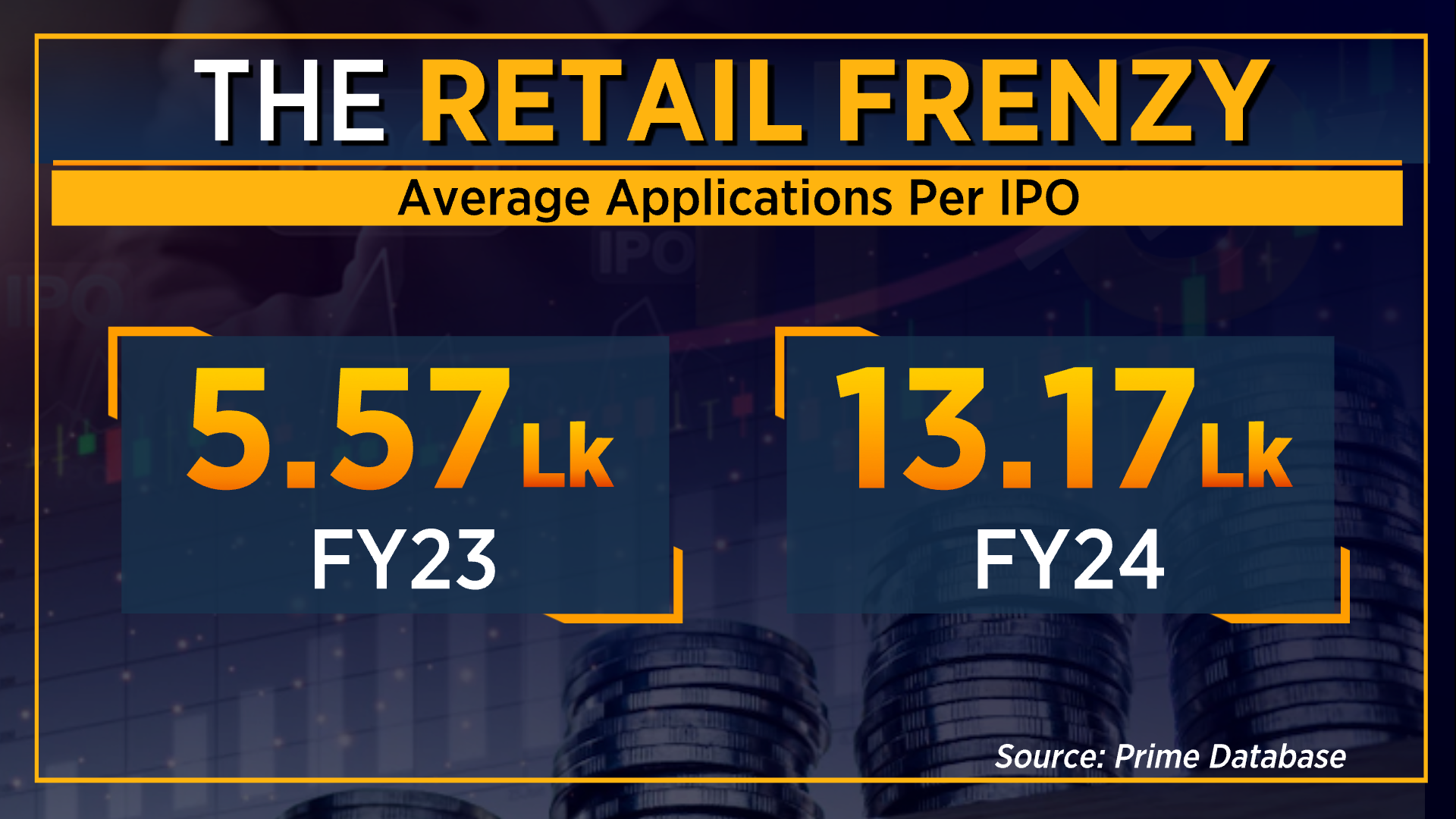

Speaking of sentiment, retail investors flocked to the primary markets to have a slice of the IPO pie as well. Take a look at this, an IPO this year saw 13.17 lakh applications from retail investors on average. That, in comparison to the previous year is more than double, where the figure was just over 5.5 lakh.

Tata Technologies, the first Tata Group IPO in two decades, saw the highest number of retail applications with over 50 lakh. DOMS Industries and Inox India complete that list and also saw hefty applications from retail investors. Interestingly, all three names have either doubled or almost doubled from their IPO price.

While we may have seen more IPOs in the year gone by, the average size of the issue has gone down. This year saw an average IPO size of just ₹815 crore, well below the ₹1,400 crore last year and over ₹2,000 crore in financial year 2022, which also saw some peak IPO frenzy.

We saw IPOs of various sizes. Less than ₹100 crore, more than ₹1,000 crore. Mankind Pharma and Tata Technologies feature as two of the biggest IPOs of the year in terms of size, between ₹3,000 crore to ₹4,000 crore. On the flip side, Plaza Wires and Vibhor Steel were the smallest with just over ₹70 crore issues. Unsurprisingly, the smaller IPO size reflects in hefty subscription numbers too.

So what lies ahead for financial year 2025? Prime database says that 19 companies, looking to raise over ₹25,000 crore already have SEBI approval and are just waiting for the iron to turn hotter before they strike. Another 37 companies with plans to raise over ₹45,000 crore through the IPO are awaiting blessings from the regulator.

First Published: Mar 28, 2024 11:27 AM IST