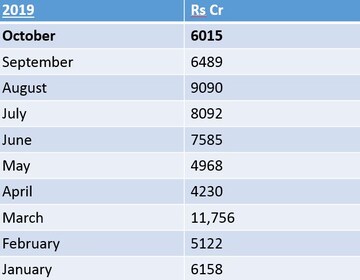

Investors handed over Rs 6,015 crore to equity mutual fund managers last month, data released by AMFI shows. This is down 7 percent when compared to the previous month of September and higher by 15 percent when compared to the 2019 monthly average.

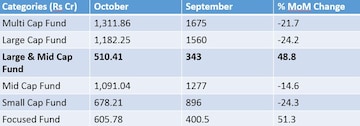

October was a good month for investors. The Nifty gained 4.2 percent, the Bank Nifty was up 3.2 percent while the Midcap and Smallcap indices jumped 5 percent and 2.7 percent, respectively. The preference for largecaps has been a hallmark of the market for some time. This crowding into largecaps has led to valuations for many of these stocks reaching sky-high levels. October data shows that investors want the safety of largecaps but also want a taste of midcaps. As a result ‘large & midcap’ category of funds saw a robust 49 percent increase MoM. All other categories, except the focused category, saw declines over September.

Equity funds in October: Where did the money go?

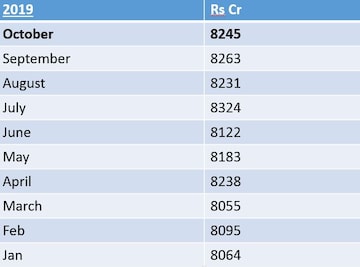

Systematic investment plans, popularly known as SIPs, continues to be the preferred method of investing for most. SIP flow in October has stayed flat over September. Assets under management for SIPs as a category have also crossed the Rs 2 lakh crore mark last month.

SIP flows:

The Equity ETF category saw large inflows. The category took in Rs 5,906 crore in October which is nearly 6 times the number in September. The government had launched the 4th tranche of the Bharat-22 ETF in early October which was responsible for the big number last month.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

PM Modi visits Ram Mandir for first time since 'Pran Pratishtha', offers prayers before roadshow

May 5, 2024 8:59 PM

Visiting temples, obliging selfie requests, jabbing rivals – Kangana Ranaut is wooing voters on campaign trail

May 5, 2024 8:23 PM