Inox Green Energy Services' initial public offering (IPO) has been oversubscribed and while investors await share allotment on Friday, trends in the grey market suggest a dull listing of the company’s shares in the secondary market.

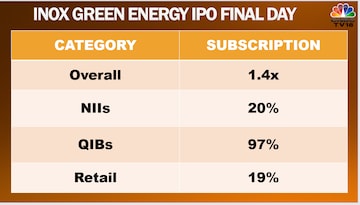

The initial share sale of the Inox Wind subsidiary received 1.55 times the subscription on the last day of the offer on Tuesday. Investors bid for 10.37 crore shares against 6.67 crore shares on offer, according to NSE data.

While retail individual investors (RIIs) portion of Inox Green IPO was subscribed 4.70 times, qualified institutional buyers (QIBs) quota received 1.05 times subscription and non-institutional investors 47 percent. The firm collected Rs 333 crore from anchor investors.

However, dealers say the company has failed to draw interest in the grey market.

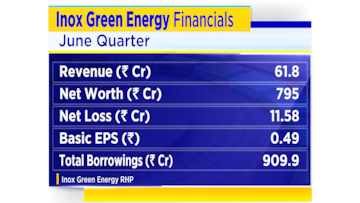

Dinesh Gupta, Co-Founder of UnlistedZone, a company that deals in unlisted securities, told CNBCTV18.com, “we don’t think there would be any interest from the IPO as the company is in losses and the wind sector as a whole is not the favour of the market.”

)

He also pointed out that the parent company Inox Wind from which Inox Green takes 100 percent of its projects is also struggling on the bourses. So, the listing is likely to be a discount one, he said.

Inox Green IPO, for which the price range was set at Rs 61-65 a share, was a fresh issue of up to Rs 370 crore and an offer for sale of up to Rs 370 crore. Proceeds from the fresh issue will be used for payment of debt and general corporate purposes.

The stock is likely to be listed on bourses -- BSE and NSE -- on November 23. This is the second time Inox Green Energy Services has attempted to go public.

How to check Inox Green IPO share allotment status

The investors can check the status online using their PAN details. Follow these steps:

–Login to the BSE website (bseindia.com/investors/appli_check.aspx)

–Select Five Star Business Finance IPO and enter your application number

–Enter PAN details and click the submit button

–You can see the Inox Green IPO allotment status on the screen

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Prajwal Revanna Sexual Assault Case: Activist raises concerns over political interference, delayed investigation in the matter

Apr 30, 2024 10:17 PM

Lok Sabha Election 2024: Baramati election outcome will decide the future of Pawar dynasty, says expert

Apr 30, 2024 10:08 PM

Lok Sabha elections 2024: Baramati to Mainpuri, key battles in phase 3

Apr 30, 2024 7:01 PM