Inox Green Energy Services’ initial public offering (IPO), through which the company aims to raise Rs 740 crore to fund its expansion plans, opened for subscription on Friday. Inox Green IPO comprises fresh issuance of equity shares worth Rs 370 crore and an offer-for-sale of shares aggregating to Rs 370 crore by promoter Inox Wind. As per the draft red herring prospectus (DRHP) filed by the firm, proceeds from the fresh issue will be used for payment of debt and general corporate purposes.

Inox Green is engaged in the business of providing long-term operation and maintenance (O&M) services for wind farm projects, specifically for wind turbine generators and common infrastructure facilities on wind farms.

Here’s a look at the key risks to Inox Green IPO

- Financial performance: In its DRHP, the firm said it is currently entirely dependent on Inox Wind Limited, its promoter for its business, and if the latter were to choose another service provider for the operation and maintenance services of wind turbine generators, Inox Green’s business, financial condition and prospects might be adversely affected.

- Demand: The demand for wind power projects and, consequently, its services depend on the cost of wind-generated electricity compared to electricity generated from other sources. “However, factors such as sustainability at low bid tariffs, adequate transmission infrastructure, continued delayed payments from state-owned discoms, poor bid response, and slow tendering/ auctioning activities may act as restraints to such addition,” it said.

- Technology: Inox Green said there had been several technological innovations within the renewable energy industry that could lead to other forms of renewable energy, such as solar or bio-diesels, emerging as more cost-competitive, thereby taking market share away from wind technology. This could adversely affect the future growth prospects of the wind energy industry in general and the company’s growth prospects in particular as an O&M service provider.

-Economic downturn: In times of economic downturns, activities such as industrial production and consumer demand decline or stagnate, causing demand for electricity to decrease.

-Supply: "We are dependent on external suppliers for spares and components," the company said. The failure of any of the suppliers to deliver spares or components in the necessary quantities, the ability to adhere to the service schedules for O&M services, or to comply with specified quality standards and technical specifications, could be impacted.

- Legal proceedings: The firm has several litigations/pre-litigations that are pending. An adverse outcome of any of these proceedings could have an adverse effect on the company, directors, subsidiaries, or the promoter, as well as its reputation, business, prospects, financial condition, cash flows, and results of operations.

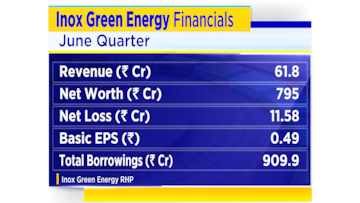

- Liability: The contingent liabilities as a percentage of Inox Green’s net worth as of June 30, 2022, was 29.79 percent. The firm noted that contingent liabilities might become actual liabilities, and if a significant portion materialises, it could hurt the business.

- Credit rating: “Any adverse change in credit ratings assigned to us may affect our ability to raise funds for future capital requirements,” the company said.

-Loan from the promoter: The firm has availed an unsecured inter-corporate loan from our Promoter, which may be recalled on demand, according to the DRHP.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Bengaluru Rural Lok Sabha election: Deve Gowda's son-in-law Manjunath to lock horns with Congress' DK Suresh

Apr 26, 2024 9:11 AM

Thrissur Lok Sabha election: Suresh Gopi, K Muraleedharan and VS Sunil Kumar locked in triangular contest

Apr 26, 2024 8:51 AM