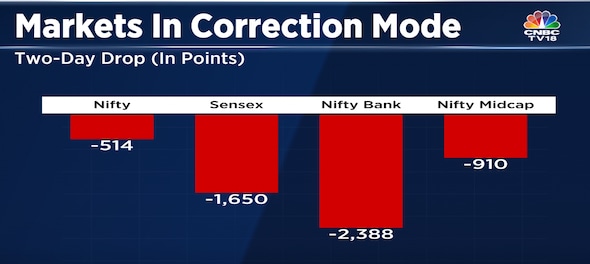

Indian equity markets have witnessed their biggest two-day drop since September last year with investor wealth worth Rs 11 lakh crore being wiped out.

The Nifty 50 index broke below the 17,500 mark, a key level, during the day before recovering. Yet, the index of India's biggest blue chip stocks closed at its lowest in three months.

37 stocks on the Nifty 50 ended with losses on Friday.

For the week, the index declined 2 percent, its biggest weekly drop in a month.

Jai Bala of cashthechaos.com has highlighted 17,428 as the last level of hope for the bulls on the Nifty 50. In case the index was to break below this level, then it could correct to the June lows of 15,000 and that, according to him the medium term outlook.

"We could see extreme short term bounces come through, but they're very clearly on a sell on rise markets and these short term bounces are likely to be very fleeting," he said.

Financials were the biggest drag on the market over the last two trading sessions.

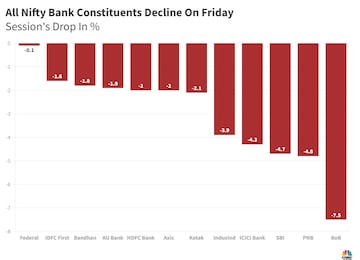

The Nifty Bank lost another 1,300 points on Friday, adding to Wednesday's 1,000-plus point drop. The index has now lost close to 6 percent in the last three trading sessions. This was the Nifty Bank's biggest weekly drop in nearly a year.

All 12 constituents of the Nifty Bank index ended with losses.

Despite correcting over 2,000 points in two sessions, Bala believes that the Nifty Bank still has considerable downside with ICICI Bank and State Bank of India leading the way down.

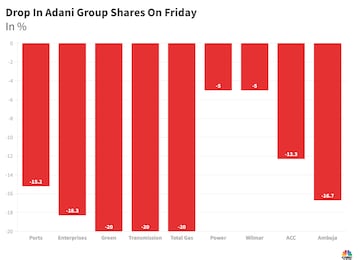

Banks are witnessing a sell-off courtesy the meltdown seen in the Adani Group companies over a research report. All Adani Group companies had double-digit losses on Friday, barring those whose circuit filter was 5 percent. Over a two-day period, the Adani Group companies have lost market capitalisation worth Rs 4.2 lakh crore.

Here's how the Adani Group companies fared on Friday:

Jefferies had put out a note on the Adani Group and mentioned that over the past five-six years, the group has diversified its borrowing mix and reduced the share of Indian banks in their borrowing.

“We do not see any material risk arising to the Indian banking sector,” the note said.

Broader markets continued to underperform with the Nifty Midcap index declining for the fourth straight week. India Cements, Glenmark, Container Corporation were among the top losers on the Midcap index.

Dipan Mehta of Elixir equities attributed the market sell-off to poor sentiment which has been hit by the research report on the Adani Group and multiple foreign investors saying that Indian stock valuations are expensive.

"What we are seeing here is a shakeout taking place of all the weak players and the leveraged players over here. Stocks are gradually moving into stronger hands per se," he said.

However, Mehta believes that the correction is a great opportunity to get into good quality growth businesses where valuations have now become reasonable.

"Investors especially long term ones who are focused on good quality outstanding businesses where there is earnings visibility and good corporate governance standards, for them this is a very good opportunity and they should look at increasing their exposure to equities," he said.

First Published: Jan 27, 2023 3:42 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Just 8% women candidates contested first two phases of Lok Sabha polls

Apr 29, 2024 12:00 PM

The sexual assault case against Prajwal Revanna — here's what we know so far

Apr 29, 2024 11:36 AM

Repolling underway at one polling booth in Chamarajanagar LS segment in Karnataka

Apr 29, 2024 10:32 AM