Global asset management firm Bernstein, which began 2022 with a cautious view on Indian equities, sees more pain ahead in the second half of the year.

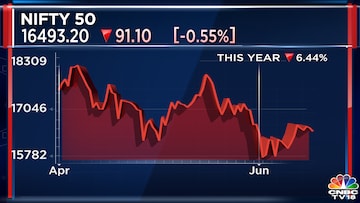

"While the index is only down around 6 percent year-to-date (till May-end), the underperformance has been much worse if we look deeper," Rupal Agarwal, senior research analyst, Asia Quantitative Strategy at Bernstein, said in an interview with CNBC-TV18.

"On an equal-weighted basis in dollar terms, markets are down 11 percent with 47 percent of stocks in MSCI India and 58 percent in BSE500 down more than 10 percent," Agarwal said.

Since the start of this year, the Nifty50 has fallen 6.4 percent, and that too with a slight uptick in the past week of trade as seen in the chart above.

According to a June 5 note by Bernstein, while robust earnings and strong domestic flows have helped markets, the pace of earnings downgrades is likely to increase as India enters a period of slowing growth and high inflation.

The brokerage sees five risks for Indian shares:

Stagflation or slowing growth with high inflation

Valuations still expensive with record-high crowding risk

Beginning of earnings downgrade cycle

Record bullishness amid challenging market structure

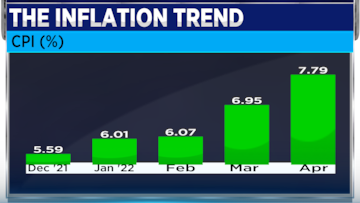

Foreign flow to remain weak, a retail sentiment likely to wane"Stagflation, the way that we are defining it, is slowing growth and higher inflation. We are definitely not considering the unemployment angle to stagflation, but only from growth and inflation perspective, India's definitely facing higher inflation, much above RBI’s range, and we are now seeing signs of slowing growth," explained Agarwal.

He added that the leading growth indicator has now moved into the contraction territory, which has historically not always led to an actual technical recession but it has always led to a material slowdown. "Hence, we say India enters into stagflation," Agarwal said.

India's

retail inflation as measured by the Consumer Price Index (CPI) surged to 7.79 percent in April. It is noteworthy that retail inflation has remained above 6 percent since January 2022.

The senior research analyst at Bernstein also said that India might see some earnings downgrades.

"I think India now on an aggregate is actually seeing net earnings downgrades. In my mind, I think it's just at the beginning of an earnings downgrade cycle," Agarwal said.

For the full interview, do watch the video

(Edited by : Abhishek Jha)