Most Indian IPOs that have come out over the last 18 months have either used part or most of their proceeds to repay debt, an analysis by CNBC-TV18 shows.

An analysis of the 75 IPOs that came out from the start of 2022 till date show that nearly 90 percent of such IPOs have used their proceeds to repay debt or use it for funding their working capital requirements.

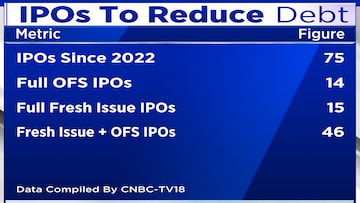

Out of the 75 IPOs since 2022, 14 of them have been fully through an Offer For Sale (OFS) route, which means that those 14 companies did not receive any money through the IPO. So the analysis boils down to the remaining 61 IPOs.

Of the 61 IPOs that were not a complete Offer for Sale, 54 have used either part or most of their proceeds to reduce debt or to fund working capital expenses.

Only 38 out of those 61 IPOs have used part of their proceeds raised through a fresh issue of shares either for capacity expansion or for funding inorganic growth.

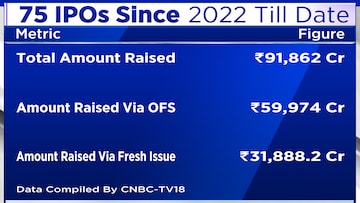

Close to Rs 1 lakh crore was raised through these 75 IPOs. Of this amount, nearly Rs 60,000 crore was raised through the OFS component. However, one must keep in mind that the number can also be skewed due to large IPOs like LIC, whose Rs 21,000 crore IPO, the largest in India to date, was a complete Offer for Sale.

Even for the IPOs that were a mix of fresh issues of shares and an Offer For Sale, the latter was the greater component in one-third of those issues.

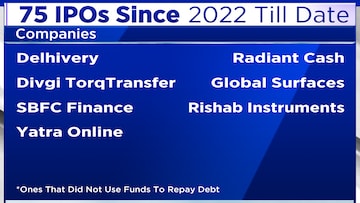

Only seven companies that went public since 2022 have not listed debt repayment as one of their aims to utilise the IPO proceeds. Those include companies like Delhivery, Radiant Cash Management and recent listings like Rishab Instruments and others.

(Edited by : Amrita)

First Published: Oct 3, 2023 10:42 AM IST