Indian equities have received three positive updates from brokerages who are advising clients to accumulate as valuations have reached a reasonable level post the recent correction.

The Nifty 50 index has corrected over 2,000 points from its all-time high of 18,888 on December 1 to the recent swing low of 16,828 on March 20.

Since then, brokerages, particularly foreign ones have turned optimistic on the market, citing reasonable valuations.

Timothy Moe of Goldman Sachs recommends buying India on dips, advising investors to buy quality as valuations are back to reasonable levels. The MSCI India index is trading at 19 times forward price-to-earnings, compared to Goldman Sachs' fair value estimate of 18.5 times.

Goldman Sachs has also retained its 12-month target on the Nifty 50 of 20,000 and remains overweight on banking and cement stocks.

Venugopal Garre of Bernstein is expecting Indian equity markets to see a quick rebound in the near-term after six months of underperformance to other emerging markets.

He further said that the call for a rebound is premised on a confluence of tactical factors, including valuations and a bunch of macro factors.

Among sectors, he cites financials, real estate and cement to be the biggest beneficiaries of this potential rebound.

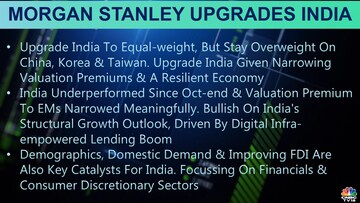

The brokerage said that it is bullish on India's structural growth outlook and that growth will be driven by a digital infrastructure-empowered lending boom, demographics, domestic demand and improving Foreign Direct Investment (FDI).

Morgan Stanley intends to focus on the financials and consumer discretionary sectors in India. It has upgraded the consumer discretionary space to overweight from equalweight earlier. It has also turned constructive on healthcare, upgrading the sector to equalweight from underweight earlier.

(Edited by : Hormaz Fatakia)

First Published: Apr 5, 2023 9:08 AM IST