Global cues will take centrestage on Dalal Street this week, with the Fed widely expected to announce a 75-basis-point hike in the key interest rates in the world's largest economy. Among major central banks, the BoE and the BoJ will also reveal their rate decisions during the course of the week.

All eyes globally will be on Fed Chair Jerome Powell's remarks to assess the state of the US economy and the future course of policy tightening. In the absence of domestic cues, the focus will remain on any wild moves in crude oil, forex rates and foreign institutional flows.

Momentum in the Indian market appears to be slowing down, with the Nifty50 expected to face strong headwinds near its previous highs, according to Apurva Sheth, Head of Market Perspectives at Samco Securities.

"The degree of immediate support is set at about 17,000. Traders should exercise care before making strong long bets," he said.

The week that was

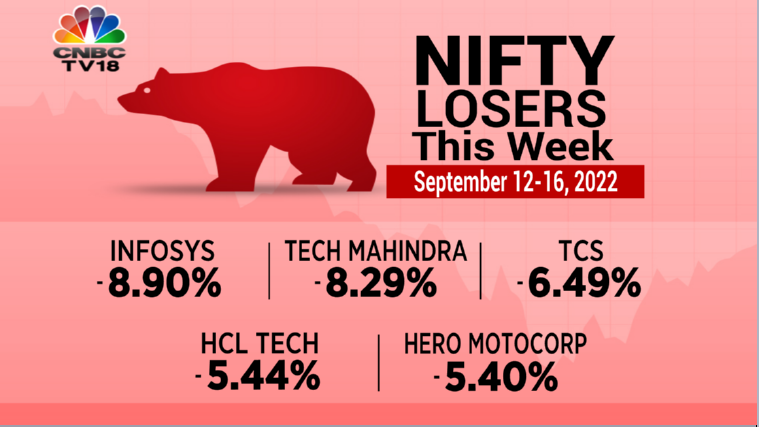

Indian equity benchmarks Sensex and Nifty50 fell last week amid strong selling pressure in IT shares as fears of recession and an undeterred pace of aggressive rate hikes.

IT, healthcare and oil & gas shares were the biggest drags on headline indices.

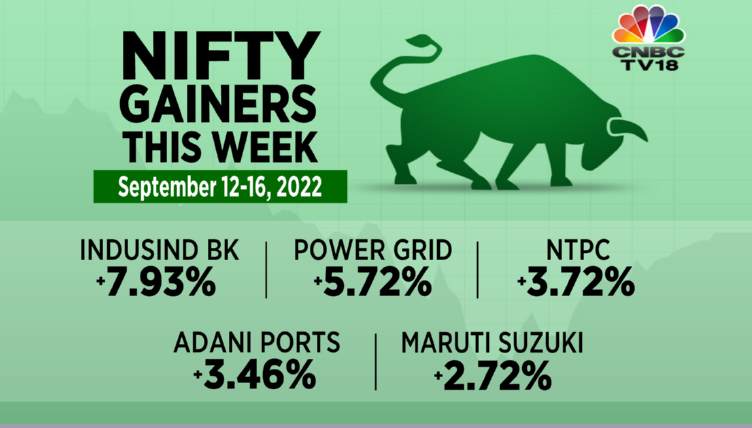

The Nifty Bank — which has 12 major lenders in the country as its constituents, including SBI and HDFC Bank, however, managed to clock a fourth straight weekly gain.

A total of 35 stocks in the Nifty50 basket succumbed to negative territory for the week.

On the other hand, IndusInd Bank, PowerGrid, NTPC, Adani Ports and Maruti Suzuki were the top blue-chip gainers.

Foreign institutional investors took to net selling of Indian shares, after being on a buying spree for several weeks. Many experts fear FIIs may remain bearish on Dalal Street for the time being.

Here are the key factors and events that are likely to influence Dalal Street in the week beginning September 19:

DOMESTIC CUES

No major macroeconomic data points are due this week.

GLOBAL CUES

| Date | US | Europe | Asia |

| Sept 19 | Eurozone construction output data | Hong Kong unemployment data | |

| Sept 20 | Housing data | ECB President Christine Lagarde to speak | Japan inflation data, China loan prime rate |

| Sept 21 | Fed rate decision and economic projections, crude oil stockpiles data, home sales data, | ||

| Sept 22 | Jobless claims data | BoE rate decision, minutes of last BoE MPC meeting, France business confidence data, Eurozone consumer confidence data | BoJ rate decision, Hong Kong inflation data |

| Sept 23 | Fed Chair Jerome Powell to speak, manufacturing and services PMI data | UK consumer confidence data; France, Germany and Eurozone manufacturing and services PMI data | Japan manufacturing and services data, Hong Kong trade data |

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Phase five Lok Sabha polls: Rae Bareli, Amethi among 14 UP seats going to polls on Monday

May 19, 2024 1:03 PM

AAP protest walk: Arvind Kejriwal challenges BJP to arrest entire party, Delhi Police imposes Section 144

May 19, 2024 12:26 PM

Terror attacks in Kashmir raise concerns ahead of May 20 and May 25 election

May 19, 2024 12:15 PM