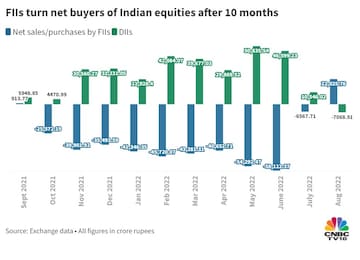

Foreign portfolio investors (FPIs) emerged net buyers of Indian equities in August 2022 — the first month of net inflows for Dalal Street since September 2021. Net purchases by FPIs stood at Rs 22,025.8 crore for the month, according to provisional exchange data.

The market will remain shut on the last day of the month for Ganesh Chaturthi.

Net sales by domestic institutional investors (DIIs), however, stood at Rs 7,068.9 crore, according to the data. That marked the first month of DIIs' outflows for the Street after 16 months.

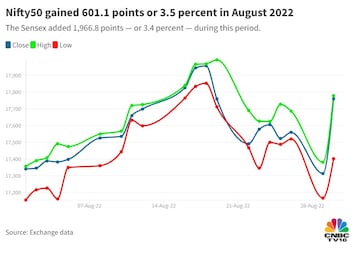

The return of FPIs to Indian equities is reflected in more than three percent of surge in headline indices for the month.

Many experts, however, have been skeptical about the sustenance of the trend of FPI buying given strength in the US dollar, which has held on to 20-year peaks for the past few weeks. Most of them have avoided calling it a firm reversal in the trend.

FPI inflows were one of the primary reasons behind an 18-month-long, liquidity-driven rally in the Sensex and the Nifty50 that came to a halt in October 2021.

On Tuesday, the Nifty crossed all six of its main simple moving averages in a bullish sign.

Yet, the benchmark is about five percent away from its all-time high, though having escaped the bear zone entered earlier this year.

A stock or index is said to be in bear territory when it retreats at least 20 percent from its recent high.

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Meet Amritpal Singh, the separatist leader contesting Lok Sabha polls from Punjab's Khadoor Sahib

Apr 27, 2024 7:18 PM

Karnataka BJP candidate K Sudhakar booked for attempting to bribe IAS officer to release money seized by EC

Apr 27, 2024 6:08 PM

Vizag as executive capital, hike in welfare pensions: Key points in YSRCP's election manifesto

Apr 27, 2024 4:03 PM

Supreme Court verdict on EVMs — why upholding the voter’s trust is important

Apr 27, 2024 2:23 PM