February 2024 will mark the first anniversary of the pioneering municipal bond index. As of February 9, 2024, the index has delivered a commendable 8.72% in returns, highlighting the growing interest and stability. Currently featuring 28 municipal bonds issued by 10 different issuers, all boasting credit ratings in the AA category, the index encompasses diverse maturities.

The municipal bond index has been an important step towards helping municipalities raise money by tapping the capital market. Recently, Martin Raiser, Vice President for South Asia at the World Bank told CNBC TV-18, that the bank is looking to push for more municipal bonds in India. Raiser emphasized the importance of municipalities utilizing local capital markets for financing. He highlighted the potential for well-managed municipalities to tap into this source of funding, with the World Bank ready to assist those not yet considered creditworthy through credit enhancement techniques.

"Municipalities in India have the advantage of developed capital markets, but the issuance of bonds from these entities is still relatively limited. We have plans to assist in this area, but there is substantial work to be done," stated Martin Raiser.

So, what exactly does the municipal bond index represent? It monitors the performance of municipal bonds issued by various Indian municipal corporations, adhering to the Securities Exchange Board of India's Issue and Listing of Municipal Debt Securities Regulations, 2015. Acting as debt instruments, these bonds are issued by local government bodies to raise funds for crucial infrastructure projects.

Investors in municipal bonds essentially lend money to municipalities, receiving periodic interest payments and the principal amount upon maturity. This form of investment plays a pivotal role in financing urban development and public projects while providing investors with a relatively stable investment option.

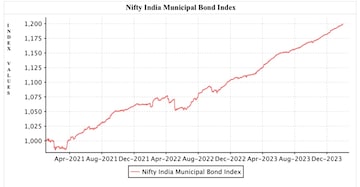

The constituent bonds within the index are assigned weights based on their outstanding amounts. Utilizing the total return methodology, factoring in both price and coupon returns, the index's computation guarantees a holistic assessment of performance. With a base date set at January 1, 2021, and an initial value of 1000, the index undergoes quarterly reviews to maintain its relevance and accuracy.

The municipal debt security regulations came into effect in 2015. Here’s a look at the index value movement since then.

Source: NSE

Although the municipal bond index is just a year old in India, the bonds were allowed by the government in 2015. The concept has been around for a while globally. One of the oldest municipal bond indexes in the world is the Bond Buyer Municipal Bond Index in the United States. Established in 1911, this index tracks the average yields of 25 general obligation municipal bonds. Another notable municipal bond index with a long history is the S&P Municipal Bond Index.

For retail investors how much sense does it make? However, Just like any other bonds these bonds carry credit riisk, interest rate volitality risk and liquidity risk.

“Retail investors are better off with well managed high credit quality debt mutual funds where the fund manager can preperly select bonds after a thorough due delligence as retail investors may not undertand the risks associated while purchasing bonds directly. Just because these bonds are issued by local government bodies it does not mean they are fully safe and secured. Investors looking for soverign grade safety can look at G-Sec mutual funds, RBI Bonds and Post Office Schemes. Apart from this investors can also look at investing in high credit quality corporate bond funds as well. Yields are still elevaled and the interest rate cut cycle has not yet begun, investors can look at investing in medium and/or long duration products,” says Rushabh Desai, Founder, Rupee with Rushabh Investment Services.

First Published: Feb 13, 2024 1:33 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

BJP's Hindi heartland dominance faces test in phase 3 polls

May 2, 2024 9:14 PM

Lok Sabha Election: Re-elections at a Ajmer booth after presiding officer misplaces register of voters

May 2, 2024 4:54 PM