India equity funds have emerged as the frontrunners in terms of global investment flows. This trend signifies the growing confidence of investors in the Indian market's potential for long-term returns. While various factors contribute to this success, India's strong economic growth, robust corporate sector, and ongoing structural reforms have played a pivotal role in attracting significant investments.

In an interview with CNBC-TV18, Cameron Brandt, Director of Research at EPFR Global said that India's equity funds have witnessed the strongest flows globally. This surge in investment can be attributed to the increasing interest of investors in long-term prospects. Furthermore, as the US Federal Reserve contemplates its last rate hike,

India's equity market appears poised for continued growth and stability.

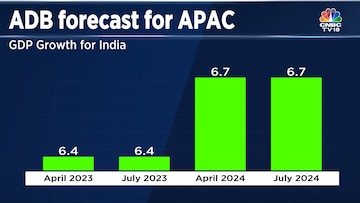

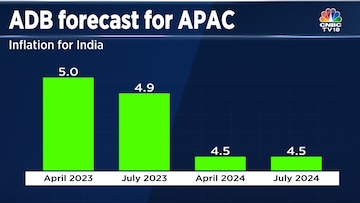

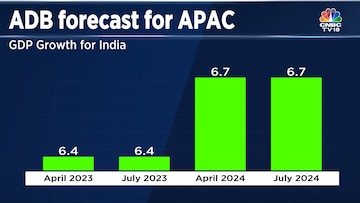

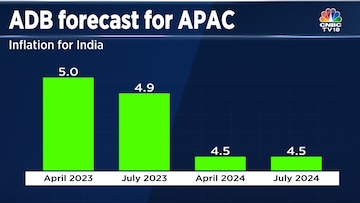

Asian Development Bank

“The latest picture is that flows continue to have extremely strong momentum. Among the major emerging markets, and country fund groups so far in July,

India equity funds have had by far the strongest inflows, and we are seeing that spread over to the fixed-income side. Dedicated in India bond funds are also at the top of their peer group in the emerging bond fund country groups,” he said.

Talking about long-term investments, Brandt revealed that approximately 60-70 percent of these funds are directed towards long-term strategies. This inclination toward sustained investment aligns with the belief in India's economic resilience and potential for consistent growth over an extended period.

The strong performance of Indian equity funds can be attributed to the country's conducive investment climate. India has implemented several reforms in recent years, such as the introduction of the goods and services tax (GST), the Insolvency and Bankruptcy Code (IBC), and initiatives to improve the ease of doing business. These reforms have created a transparent and investor-friendly environment, fostering confidence among both domestic and international investors.

Asian Development Bank

Also, according to a

report by Invesco Global Sovereign Asset Management, India has surpassed China and emerged as the most appealing emerging market for sovereign wealth funds to invest in this year. The study attributes this shift to India's strong demographic profile, political stability, and proactive regulatory measures.

(with inputs from Asian Development Bank/agencies)

For more details, watch the accompanying video

(Edited by : C H Unnikrishnan)

Asian Development Bank

Asian Development Bank Asian Development Bank

Asian Development Bank