Hindustan Unilever Vs Bharti Airtel, yes, you read it right!

Before you believe it is not a fair comparison, think about it. You probably require your phone and mobile data as much as you need your shampoo and soap. In fact, you may need mobile data to order the same shampoo and soap from the nearest quick-delivery service!

That is what Jefferies believes too and hence, this comparison, highlighting both these respective sectoral giants as a play on India's consumption story.

Interestingly, as different as these two stocks are, there are multiple similarities between the two as well.

For instance, a decade ago, both had similar market capitalisation and its no different even in 2024 as they both are currently at ₹6 lakh crore market capitalisation.

An adverse regulatory environment coupled with rising competition weighed on Bharti Airtel until 2019, whereas margin-led growth had propelled HUL's market capitalisation to be triple of the telecom giant at one point, according to Jefferies.

Both companies also operate in industries that have similar addressable markets. The telecom industry has grown at a Compounded Annual Growth Rate of 5.5%, while the FMCG industry grew by 7% over the last decade.

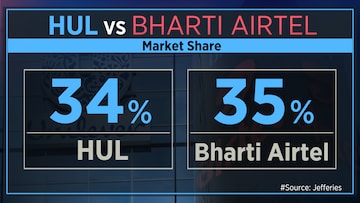

If these isn't enough similarities, both companies also have a nearly similar market share of around 34% to 35%.

Now, here's a difference. While Bharti's market share is uniform across regions, which reflects a largely consolidated market, HUL operates in a very competitive market across most of its categories.

Over the last decade, Bharti Airtel's revenue has grown at a 6% CAGR and Earnings before Interest, Tax, Depreciation and Amortisation (EBITDA) grew at 9%. On the other hand, HUL's revenue and EBITDA has grown slightly faster, at 9% and 12% respectively, over the same period.

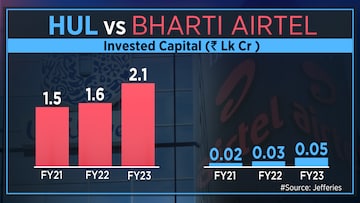

A standout for HUL though, is the strength of its balance sheet. Bharti's invested capital is over ₹1.5 lakh crore and touched ₹2 lakh crore last year, whereas HUL invests just over 2.5% of that amount on an annual basis. In fact, if you account for the cash that HUL generates, their invested capital is a lot lower.

That explains why Bharti Airtel has a net debt worth over ₹2 lakh crore, while HUL, on the flip side, has a cash balance of nearly a billion dollars. This, despite having a much higher dividend payout ratio of nearly 90%.

The question to be asked though, is what next?

Jefferies believes that entry barriers in the FMCG industry are going down, while the barriers to entry in the telecom market have significantly increased. Competition is increasing in the consumer space, even as the telecom market is moving towards a duopoly.

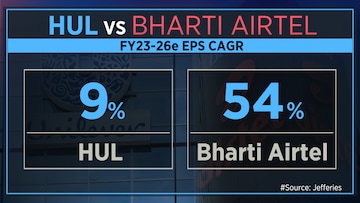

However, growth and valuations are both at odds and at a disadvantage for HUL. In fact, Jefferies is expecting a 9% EPS CAGR for HUL compared to a 54% CAGR projected for Bharti Airtel over financial year 2023 - 2026.

Hence, their view is, a better defensive play on India’s consumption story would be Bharti and not HUL at the current juncture. Therefore, they have a BUY rating on Bharti with a target of 1300 while they recommend a HOLD on HUL with a target of 2800 per share.

Therefore, Jefferies' view is that Bharti Airtel would be a better defensive play on India's consumption story and not Hindustan unilever. As a result, they have a "buy" recommendation on Bharti with a price target of ₹1,300, while they have a "Hold" rating on HUL with a price target of ₹2,800.

(Edited by : Hormaz Fatakia)

First Published: Jan 11, 2024 12:37 PM IST