India's state-run oil refiners, Hindustan Petroleum Corporation (HPCL), Bharat Petroleum )(BPCL) and Indian Oil Corporation (IOC) has left the analyst community divided over its prospects going forward. There have been a slew of upgrades, downgrades and price target revisions on all these three names after these three names have rallied between 30% to 40% so far in 2024.

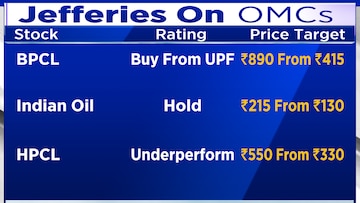

On February 16, Jefferies upgraded BPCL to "buy" from its earlier rating of "Underperform." It also increased its price target on the refiner sharply to ₹890 from ₹415 earlier, saying that BPCL offers the largest margin of safety among the three companies.

While Jefferies maintained its "hold" and "underperform" rating on Indian Oil and HPCL respectively, it raised its price target on both these stocks to ₹215 from ₹135 and to ₹550 from ₹330 respectively.

Morgan Stanley mentioned that a well-supplied oil market, hardware upgrades and refining golden age will drive the next leg of earnings upgrades. It highlighted HPCL and BPCL as its preferred picks.

The consensus Earnings Per Share (EPS) estimates for financial year 2024 for these OMCs remain "too low" according to JPMorgan, who is overweight on BPCL and Indian Oil, while staying neutral on HPCL.

On Wednesday, Nuvama downgraded all three stocks - HPCL, BPCL and IOC to reduce, saying that these stocks have rallied despite being structurally disadvantaged. It expects a fall in the earnings of these companies as Gross Refining Margins (GRMs) normalise.

"OMCs now quote way above their past valuations, even at a premium to the US peers with inherent edge from low-cost WTI," Nuvama wrote in its note.

Shares of HPCL are trading 0.8% lower on Wednesday, BPCL shares are down 0.6%, while those of Indian Oil are down by a similar quantum.