Avendus Capital Public Markets Alternate Strategies has noticed a clear shift in trend towards more high-end products in the beverages industry, both alcoholic and non-alcoholic.

The investment firm, part of Avendus Group, which manages over $800 million in assets, believes the sector is changing, with a focus on better quality and more luxurious drinks. This change reflects what customers want and how the market is evolving.

Avendus CEO, Andrew Holland, told CNBC-TV18 that luxury drinks are becoming more popular, especially in travel and entertainment, and this trend is likely to continue for the next 3-5 years.

Echoing Holland's views, CRISIL Ratings in its latest note highlighted a rising trend in luxury drinks, projecting significant growth in India's organised liquor industry due to increased demand and premiumisation.

"Strong demand and premiumisation will lead to India’s organised liquor industry revenues growing 12-13% this fiscal to ~₹4.45 lakh crore, after a 15-16% growth last fiscal," the note released on December 5 stated.

Nuvama Institutional Equities' latest analysis highlights growth in the alcohol industry, driven by an upswing in events and weddings. The brokerage firm noted that the liquor industry's profits are recovering after a tough year.

Also Read

Abneesh Roy from Nuvama told CNBC-TV18 that beer has been growing faster than spirits, partly because it's seen as healthier.

Nuvama expects United Spirits and Radico to lead the industry with high profit margins at around 43.6%, but United Breweries (UBL), with a 40.6% margin, is facing some challenges due to various factors. UBL faced challenges in the first quarter of 2024 due to an unfavourable state mix and inflationary pressures, impacting volume growth.

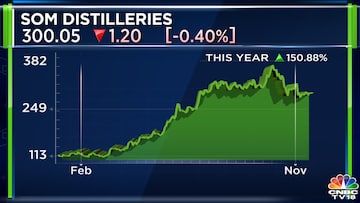

According to JK Arora from Som Distilleries, demand for beer and Indian-made foreign liquor (IMFL) is up due to changes in consumer habits after COVID-19, with more spending on travel and leisure.

The liquor industry can be broadly segmented into distillers and brewers. Distillers produce IMFL, accounting for ~65-70% of the industry’s revenues while brewers produce beer, that accounts for ~25-30% of the industry revenues, per CRISIL.

Sula Vineyards CEO, Rajeev Samant also sees a shift in preference toward the premium wine market. He told CNBC-TV18 that a big part of the Indian winery's revenue comes from premium wines, which are expected to keep growing. This focus on premium products is a key trend in the beverage industry.

(Avendus fund inputs from its official website)

To view the complete interview with Andrew Holland of Avendus Capital, please refer to the accompanying video.

(Edited by : Shweta Mungre)

First Published: Nov 24, 2023 6:05 PM IST