The home improvement sector is experiencing significant growth, with Polycab leading the charge.

Polycab India, a prominent player in the electrical sector, has achieved impressive earnings in the first quarter of the fiscal year 2024 (Q1FY24). Notably, their cables and wires business witnessed a 60 percent increase in volume during this period. The

Polycab's stock has soared by 75 percent in 2023.

Finolex Industries Ltd, an integrated manufacturer of PVC pipes and fittings, displayed significant progress as well, improving its margins by 100 basis points compared to the previous year.

The sectors's upturn can be attributed to declining raw material costs and an upswing in demand, which have provided much-needed impetus to the sector.

Kajaria Ceramics, currently trading at a 52-week high, is set to release its Q1 earnings on July 26. Market analysts from Motilal Oswal expect the company to achieve a volume growth of nine percent, with EBITDA rising by 10 percent. Moreover, Kajaria Ceramics is focusing on expanding its capacity and dealership network to further fuel its growth.

KEI Industries, a notable cables manufacturer, will announce its Q1FY24 earnings on July 31. The company had previously projected strong growth for FY24, with revenues expected to increase by 16-17 percent.

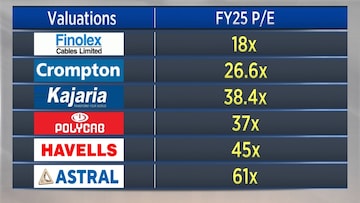

Despite the industry's overall success, a concern lies in the valuations of most companies. Astral's valuation stands at 61 times earnings, Havells at 45 times, and Polycab at 37 times earnings, indicating relatively expensive valuations for these stocks.