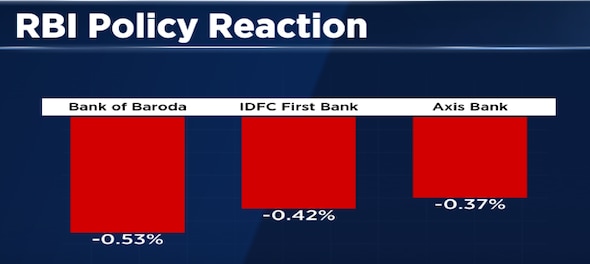

Banking stocks trimmed early gains in morning trade on Wednesday with the Nifty Bank declining around 390 points from the day’s high after the RBI raised the key short-term lending rate by 25 basis points to a four-year high of 6.5 percent. Among major losers, Bank of Baroda declined by 0.53 percent to Rs 167.65, IDFC First Bank by 0.42 percent to Rs 59.65 and Axis Bank by 0.37 percent to Rs 875.85 on NSE.

ICICI Bank, Bandhan Bank, PNB, SBI, HDFC Bank and IndusInd Bank also trimmed gains following the announcement of the RBI policy.

The Nifty Bank index opened strong and touched a high of 41,791.95 in morning deals ahead of the announcement. It later fell to a low of 41,403.05.

BSE Bankex also retreated from the day's high of 47,295.78 to trade marginally up at 47,006.05.

Earlier in the day, RBI Governor Shaktikanta Das announced a repo rate hike of 25 basis points to 6.50 percent, the highest since February 2019. Moreover, the RBI pegged India's economic growth lower at 6.4 percent in FY24 against 7 percent in FY23 due to risks from geo-political tension and tightening global financial conditions.

The RBI said that it would keep a strong vigil on the inflation outlook as core inflation is expected to remain sticky. Inflation is expected to moderate but will remain above the targeted 4 percent level in the next fiscal year, the RBI said in its policy statement. Retail inflation will average 6.5 per cent in 2022-23 and moderate to 5.3 per cent in 2023-24.