The market snapped from its three-week rally as the bulls were completely trapped throughout week that ended on October 4.

Rising concerns over banks' exposure to NBFCs and real estate after PMC Bank-HDIL fraud and Lakshmi Vilas Bank placed under Reserve Bank of India (RBI)'s prompt corrective action hit market sentiment.

The fall in Goods and Services Tax (GST) collections to a 19-month low, weak September auto sales YoY (though improved MoM), a lower-than-expected repo rate cut and the reduction in full year GDP growth forecast by RBI along with global economic slowdown fears also dampened the mood on the street.

The BSE Sensex and Nifty50 fell 3 percent each during the truncated week after rising 5 percent each in their previous three consecutive weeks, which indicated that the corporate tax rate cut's momentum is waning.

Experts feel that as the market entered into an oversold zone, it is expected to see some bounce back initially in the coming truncated week, partly backed by the US jobs report that lifted Wall Street.

But overall, it may remain volatile ahead of the September quarter earnings season and till the results of recent government measures along with transmission of rate cuts.

"Since we are heading towards the earnings season, a lot of cues will now be taken from important results of TCS, Wipro, and Infosys. Volatility may be inching up in specific sectors and some rotation may be seen. With that, we will also see global developments taking the lead and influence since everyone has their eyes on the US-China trade war," Mustafa Nadeem, CEO, Epic Research told Moneycontrol.

Vinod Nair Head of Research: Geojit Financial Services said, "Despite cut in taxes and government stimulus, the broad economy will take more time to gain and invest in new projects. Having said that the worst for domestic economy may be over by Q2–Q3 FY20.

"We can expect a faster recovery in consumption led by the stability in the job market, festive seasons and a reduction in interest costs. This quick benefit cannot be replicated in non-consumer segment as financial sector and new investments have a lag-effect," he added.

The broader markets fell more than frontliners with the BSE Midcap and Smallcap indices losing nearly 4 percent each while all sectoral indices, barring IT and Energy, closed in the red.

The market will remain shut on October 8 for Dussehra.

Here are 10 key things that will keep traders busy this week:

Earnings

The July-September quarter earnings season will begin later in the coming week. Among large caps, Infosys, TCS and IndusInd Bank numbers will be key to watch out for.

Goa Carbon, GM Breweries, Bajaj Consumer Care, Hathway Bhawani Cabletel, Den Networks, Avenue Supermarts, ITI, California Software Company etc will also announce their results during the week.

"The earning season for Q2FY20 is unlikely to throw any surprises. RBI’s downward revision of GDP growth to 5.3 percent for Q2FY20 (in the backdrop of 5 percent growth in Q1FY20) from earlier 5.8-6.6 percent in H1FY20 says it all," Pankaj Bobade, Head of Fundamental Research, Axis Securities told Moneycontrol. All eyes would now be on the management commentary to understand how they see the performance for the rest of the year, he said.

TCS

Tata Consultancy Services (TCS), country's second-largest company by market cap, will announce its quarterly earnings on October 10. Brokerages feel overall numbers are expected to be steady during the quarter with constant currency revenue growth at around 3 percent.

Edelweiss expects TCS to deliver 3.5 percent constant currency revenue growth QoQ (2.9 percent in USD owing to cross-currency headwinds) as softness in European BFSI space to be offset by

strong growth metrics in North America.

The margin growth could be around 90-100bps QoQ and is expected to be supported by rupee depreciation in the absence of wage hikes while the profit may be flat to marginally positive on a sequential basis.

"We expect EBIT margins to improve by 90bps sequentially to 25.1 percent, aided by growth leverage, absence of wage increments, visa expenses and a slight INR depreciation.

Key issues to watch for would be the outlook and visibility for double-digit growth in FY20, the rajectory of margins amid rising sub-contractor expenses, its growth in the retail vertical, the commentary on the macro environment spends by retail clients, its growth in digital and BFSI, and manufacturing demand in North America and Europe.

Infosys

Infosys, the country's second largest IT company, is also expected to deliver steady growth in Q2FY20 with constant currency revenue growth of more than 3 percent QoQ supported by Starter NV deal and the likely upward revision in full year revenue guidance. The company will announce its numbers on October 11.

"We expect constant currency revenue growth of 3.6 percent and cross currency headwind of 58 bps; revenue growth will also be aided by Starter N.V deal (50bps)," Prabhudas Lilladher said.

Brokerages feel the EBIT margin is likely to improve by 90-100bps sequentially owing to a weak rupee and operational efficiencies, and the absence of wage hikes while full year constant currency revenue growth could be revised to 9-11 percent from 8.5-10 percent currently.

Hence apart from the full year revenue growth guidance, the total contract value of large deal acquisitions, the commentary of US & European BFSI verticals, revenue conversion of past deals, outlook on margins for FY20 and attrition rate would also be closely watched.

US-China Trade Talks

Chinese and US officials will be meeting later this week to strike a trade deal, which will key to watch out for globally as the trade war continues to impact global growth after both countries started putting tariffs on billions of dollars worth of goods on each other.

A high-level Chinese delegation is coming to the US for two-day meeting (October 10-11) for talks with officials from Trump's administration, including US Trade Representative, Robert Lighthizer, Commerce Secretary Wilbur Ross and Treasury Secretary Steven Mnuchin.

US President Donald Trump on October 4 said that he would like to have a trade deal with China only if it is a great one for his country. He further said he has a very good chance of making a deal with China.

"Right now, we are in a very important stage in terms of possibly making a deal. If we make it, it will be the biggest trade deal ever made," the president said.

FII Outflow

The consistent outflow of foreign money is one of reasons for correction and weak sentiment in the market, which suggests that they continued to be on risk-off mode on account of global slowdown and trade issues.

Foreign institutional investors (FIIs) remained net sellers to the tune of more than Rs 3,200 crore in week gone by, taking total outflow to nearly Rs 44,000 crore since May this year.

On the contrary, domestic institutional investors remained strong supporters to the market as they bought nearly Rs 3,500 crore worth of shares during the week. In fact their buying since May in total (Rs 65,750 crore) was much higher than FIIs outflow.

Experts feel FIIs money may return to India once the growth starts getting back on track.

Macro Data

Industrial production data for the month of August 2019 will be closely watched by the street as it is going to release on October 11.

Industrial output grew 4.3 percent month-on-month (MoM) in July against 1.2 percent growth in June that was revised downwards from 2 percent.

Foreign exchange reserves data for week that ended on October 4, and deposit and bank loan growth for the fortnight that ended on September 27 will be announced on the same day.

Technical View

The Nifty50 fell sharply on October 4 as well as for the week, forming a large bearish candle on the daily and weekly charts which indicated the bears have an upperhand on Dalal Street.

The index has also broken its 200 DEMA to close below the 11,200 level at 11,174.75 and resistance is also gradually shifting lower. Experts feel the index has strong support around 11,000-11,100 levels and if it breaks the same then there could be steep fall in market while if it gets back above 11,200 then there could be short covering.

"Markets have erased almost 3 percent of its gains last week and it is now very important for the market to hold the 11,100-11,150 levels. If those are taken out on a closing basis we may be going back in the range of 11,000-10,800. That is very bearish given the buying that was seen. But we believe this bearishness should be till 11,100 levels. That is an important point, and, since the undertone is bullish we may see some buying coming in," Mustafa Nadeem, CEO, Epic Research said.

F&O Cues

Option data suggests a shift in the lower trading range for the Nifty to around 11,000 to 11,600 levels.

Maximum Put open interest is at 11,000 followed by 11,200 strike while maximum Call open interest is at 11,500 followed by 12,000 strike. Call writing was seen at 11,300, followed by 11,500 and 11,800 strikes whereas marginal Put writing was seen at 11,200 then 11,000 and 10,500 strikes.

"The noticeable Put base is placed at 11,000 Put strike. However, some positions at this strike have shifted from higher Put strikes. The noticeable Call base is placed at 11,500, which means the Nifty may enter into short-term consolidation with immediate support at 11,000," Amit Gupta of ICICIdirect said.

India VIX moved up by 9.12 percent from 16.11 to 17.58 levels during the week.

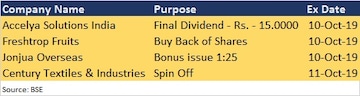

Corporate Action

Here is the list of corporate action taking place in the coming week:

Global Cues

Along with US-China trade talks, here are other key global data points to watch out for in coming week:

Source: Moneycontrol.com

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Delhi Congress chief Arvinder Singh Lovely resigns

Apr 28, 2024 10:54 AM

Lok Sabha polls: Voter turnout in Rajasthan over 62%, down by 4% since 2019

Apr 28, 2024 8:49 AM