What were you doing on June 12, 2000,—yes, 19 years ago the same day? Well, I remember what I was doing. Fresh out of college, a small internship job, no care for the future and measuring every part of New Delhi on my bike. But in the financial world, 19 years ago, there was an event which shaped up how the Indian markets will trade forever. The Nifty futures were launched.

In a way, India already had a Badla system but this was a more formal way of introducing forward markets into India. You could hedge your portfolio, you could take a positional bet on where the market as a whole was headed or of course, you could use it to just trade.

Over the last 19 years, Nifty futures have truly evolved as one of the biggest and most-widely traded instruments worldwide. Let’s look at the journey.

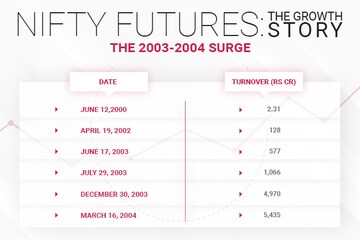

On the debut 19 years ago, the Nifty futures recorded trade volume of 2.31 crore, most of which was intraday as the overall Open Interest on day 1 was a meagre 7,400 shares. Just to put those numbers in perspective, today on an average Nifty futures trade over Rs 10,000 crore and the current Open Interest is well over 2 crore shares.

Like with most products, it took time to catch up. In fact from 2000 to 2002, the volumes remained very low and even in April 2002, it had barely crossed 100 crore threshold. And then came the bull market of 2003 and there was no looking back.

From June 2003 levels of 577 crore, the daily volumes surged to almost 5,000 crore by the end of 2003 and stabilized around that mark for the first part of 2004.

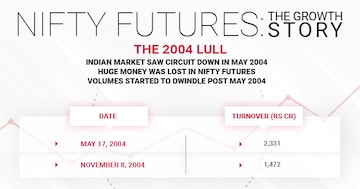

Then came a setback. The May 2004 stock market crash after the unexpected election results led to massive losses for futures traders. Many traders went bankrupt and the volumes started to gradually decline again and by November 2004, it was down almost 70 percent from the peak.

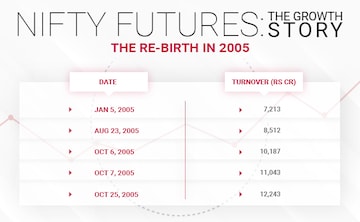

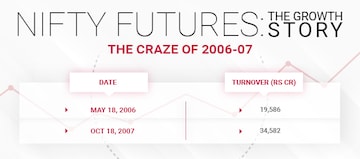

But it turned out to be a temporary setback. The comeback in 2005 was strong and brutal. By October 2005, the highest turnover had touched Rs 12,000 crore mark. The craze continued and in the peak of what remains perhaps India’s biggest bull market, by October 2007, it had touched a whopping 35,000 crores.

Since then, it has never reached those levels for a variety of reasons. For starters, the market went through an excruciating bear market and by the time we were out of it, other products had caught up, particularly Nifty options and stock futures. And as time passed, Bank Nifty futures and options (F&O) also started trading big.

Today, Nifty futures form only 10-20 percent of overall F&O volumes on a daily basis but it still remains India’s number 1 derivative instrument.

First Published: Jun 12, 2019 12:28 PM IST

Check out our in-depth Market Coverage, Business News & get real-time Stock Market Updates on CNBC-TV18. Also, Watch our channels CNBC-TV18, CNBC Awaaz and CNBC Bajar Live on-the-go!

Lok Sabha elections 2024: 28% of candidates contesting in fourth phase are 'crorepatis'

May 9, 2024 4:29 PM

Free poha-jalebi to movie ticket discounts: How cities struggling with 'urban apathy' are luring voters to polling booths

May 9, 2024 3:17 PM