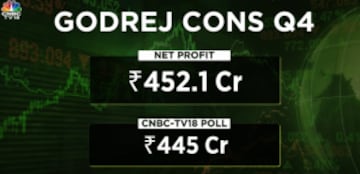

The fast-moving consumer goods major Godrej Consumer Products — whose popular brands include Cinthol, HIT, Good Knight and Ezee — on Wednesday posted a profit after tax (PAT) of Rs 452 crore for the March quarter (Q4FY23), beating estimates. This was up 24.5 percent as compared to Rs 363 crore in the year-ago period. That compares with the Rs 445 crore estimate of analysts by CNBC-TV18.

The FMCG company's

revenue growth came in at 9 per cent to Rs 3,200 crore as against Rs 2,916 crore in the same quarter of last fiscal.

Operating profit, calculated as Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA), rose 37 percent to Rs 641 crore, compared to a projection of Rs 627 crore, while margins came in at 20 percent as against 19 percent expected.

"We had a strong end to the year with volume led double-digit sales growth in 4Q FY 2023. Consolidated sales grew by 10 percent in INR terms and 14 percent in constant currency terms. We have continued to witness sequential improvement in volume growth with 6 percent year-on-year increase in Q4," said Sudhir Sitapati, Managing Director and CEO, GCPL.

"The performance was broad based with India Branded business delivering stellar volume growth of 13 percent, led by double-digit volume growth in both Home Care and Personal Care. In Indonesia, our core business performance continued to improve with ex Hygiene growth of 11 percent in constant currency terms. The double-digit growth trajectory in our Africa, USA and Middle East business was temporarily impacted by election and demonetisation in Nigeria. Our quality of profits has also been improving with Consolidated Gross Margin expansion of 180 bps quarter-on-quarter, 340 bps year-on-year and EBITDA Margin improvement of 360 bps year-on-year," Sitapati said.

GCPL shares closed 0.85 percent higher at Rs 959.60 per share in Wednesday's trade. The scrip opened at Rs 952.30 and touched an intraday high and low of Rs 966.95 and Rs 948.45, respectively. Shares of the company of Godrej Consumer Products Ltd quoted a 52-week high of Rs 994.45 and a 52-week low of Rs 708.60.

The GCPL stock has an average broker target of Rs 1,026.22, suggesting a potential upside of 5 percent, according to data from Trendlyne.

First Published: May 10, 2023 4:28 PM IST