Arvind Sanger, Managing Partner at Geosphere Capital Management believes the Reserve Bank of India's (RBI's) tightening of consumer lending rules should provide a backdrop for more announcements addressing risk in the market.

While Geosphere Capital Management currently holds a cautious stance on financials, Sanger sees potential market pullbacks as opportunities "because we cannot bet on India while thinking that financials will continue to be in the dark house – that just doesn’t happen."

He believes that select financials, especially well-positioned non-banking finance companies (NBFCs) will continue to thrive.

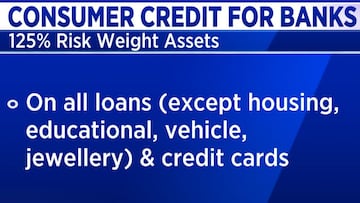

Consumer credit, excluding housing, education, vehicle, and jewellery loans, will now attract 125% RWA. Credit cards for banks will see an increase in RWA from 125% to 150%. Loans to NBFCs will attract 125% RWA versus 100% earlier. RBI's new directive is expected to bolster reserves and establish board-approved policies to control exposure in consumer lending, a response to the governor's concerns over the rapid growth in this area.

Sanger said, "In an economic cycle, we cannot expect a full cycle without the financial sector participating," even as he expressed concern over excessive risk-taking, particularly in retail unsecured loans, causing market apprehension.

Also Read

Sanger remains fundamentally optimistic about India's growth, citing the country's resilience and attractiveness to investors. He acknowledged the potential for funds to shift towards China but believed that India's domestic flows could balance any minor international outflows.

For more details, watch the accompanying video

(Edited by : Shweta Mungre)